Not too long ago, your choices for a quick drink in India were pretty predictable: cola, a packet of juice, maybe a packaged iced tea if you got lucky. That picture is changing fast. Walk through a supermarket today and you’ll see shelves stacked with cold brews, flavoured waters, protein shakes, and even mixers that feel straight out of a cocktail bar.

Curiosity and lifestyle are the main factors that are driving this shift. Young entrepreneurs are building brands around health, nostalgia, and premium experiences, and people are responding. Whether it’s a bottle of aam panna that tastes like summer holidays, or a non-alcoholic beer that lets you join the party without creating buzz, these startups are finding smart ways to stand out.

This isn’t just a new set of drinks on the market. It’s a new way of thinking about beverages in India. And the ten startups we’re about to explore are right at the heart of that story.

The Rise of D2C Beverage Brands in India

Key Growth Trends Driving the Sector

List of the Best Beverage Startups Driving Innovation in India’s Drink Sector

The Rise of D2C Beverage Brands in India

The D2C beverage sector in India is on a caffeinated rise, with homegrown startups shaking up everything from iced teas and smoothies to functional herbal infusions. Unlike traditional FMCG giants that rely heavily on retail shelves, these digitally native brands are building direct relationships with consumers through their own websites, apps, and online marketplaces.

According to recent reports, the food and beverage segment commands nearly 27% of India’s booming D2C market, making it one of the most promising categories for entrepreneurs and investors alike. The shift is fueled by health-conscious millennials and Gen Z buyers who prefer transparency, cleaner ingredients, and personalized experiences over mass-market products.

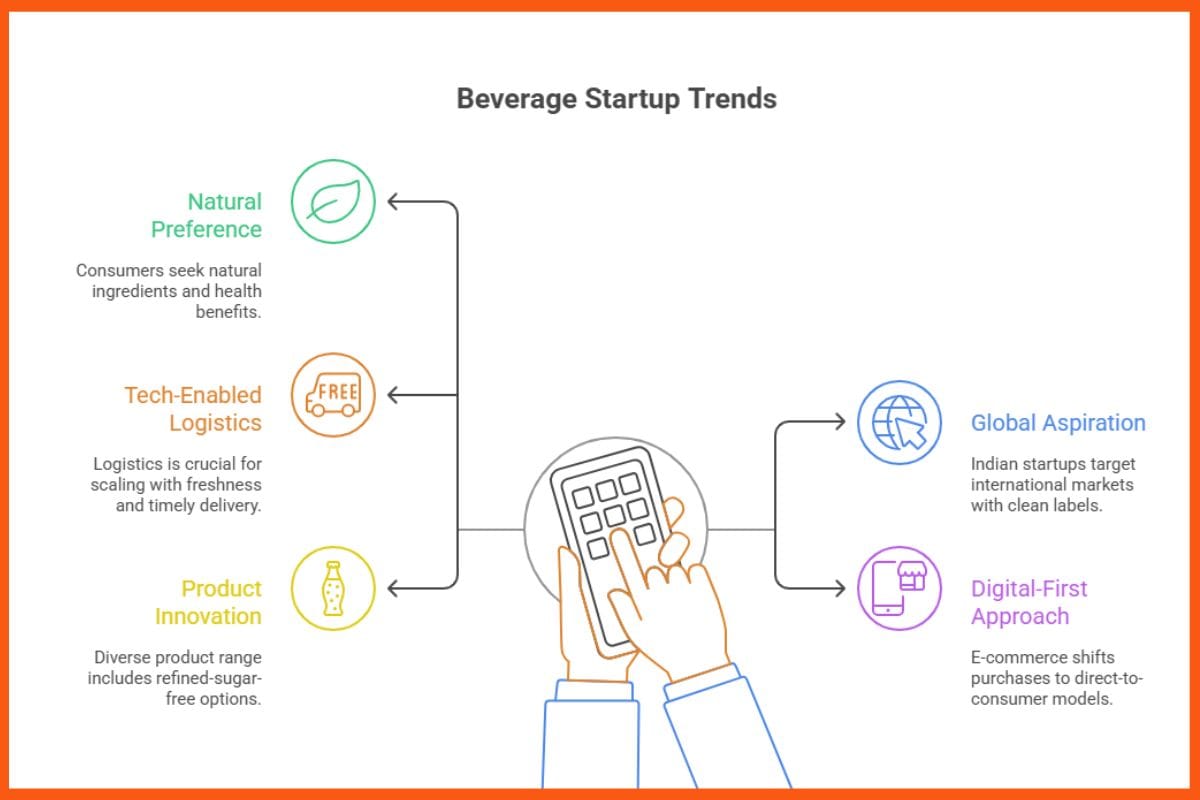

Key Growth Trends Driving the Sector

- Natural Preference: Today’s consumers actively look for natural ingredients, low-sugar alternatives, and functional benefits like immunity boosts or gut health.

- Global Aspiration: Many Indian beverage startups are going global with clean labels, vegan options, and sustainable practices to appeal to international markets.

- Freshness is King: With shelf life, cold chains, and timely fulfilment being critical, tech-enabled logistics has become a backbone for scaling these businesses.

- Digital-First Approach:The rise of e-commerce and quick commerce platforms is shifting consumer purchases from offline stores to direct-to-consumer models.

- Product Innovation: From refined-sugar-free iced teas to frozen espresso shots and flavoured water enhancers, the product range has never been more diverse.

StartupTalkyBaishali Das Adhikari

StartupTalkyBaishali Das Adhikari

List of the Best Beverage Startups Driving Innovation in India’s Drink Sector

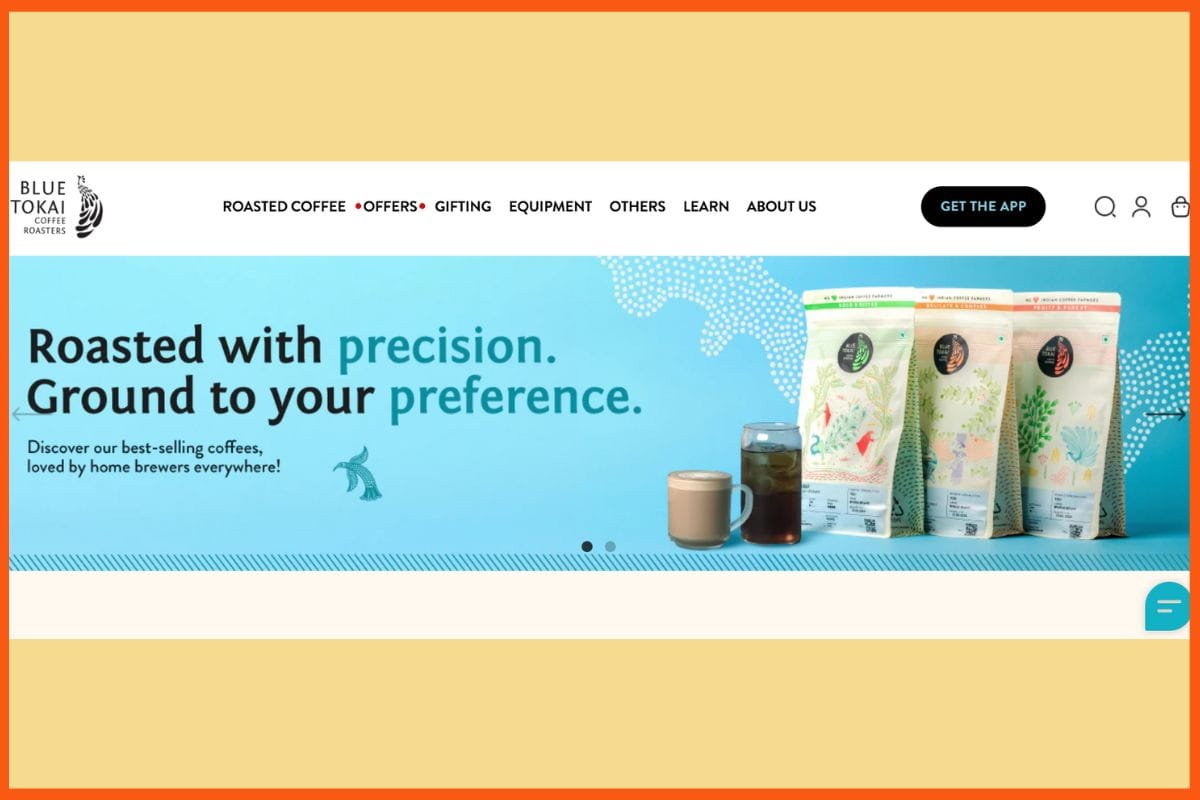

Blue Tokai Coffee Roasters

| Year of Inception | 2013 |

|---|---|

| Founders | Matt Chitharanjan, Shivam Shahi, Namrata Asthana |

| Funding Raised | $72.09 Mn+ |

| Key Investors | Verlinvest, Anicut Capital, A91 Partners, 12 Flags Group, Deepika Padukone |

| Headquarters | Gurugram |

Blue Tokai is India’s leading specialty coffee brand with 80+ cafés, four roasteries, and an outlet in Tokyo, proving strong domestic and global appeal. Backed by Verlinvest, 12 Flags Group, and Deepika Padukone, it has raised $72 Mn+ to date. With its D2C + B2B model and a fresh $35 Mn Series C round, the brand is set to expand into Tier I & II cities, making it a strong play on India’s premium café culture and scalable growth market.

StartupTalkyVivek Dev Jacob

StartupTalkyVivek Dev Jacob

Glow Glossary

| Year of Inception | 2019 |

|---|---|

| Founder | Pratishtha Rawat |

| Funding Raised | Not disclosed |

| Headquarters | Mumbai |

Glow Glossary repositions matcha as a mindful ritual, offering curated kits for holistic living. Targeting India’s growing wellness and lifestyle market, the brand represents a niche, premium opportunity for investors in the health-focused, D2C beverage segment.

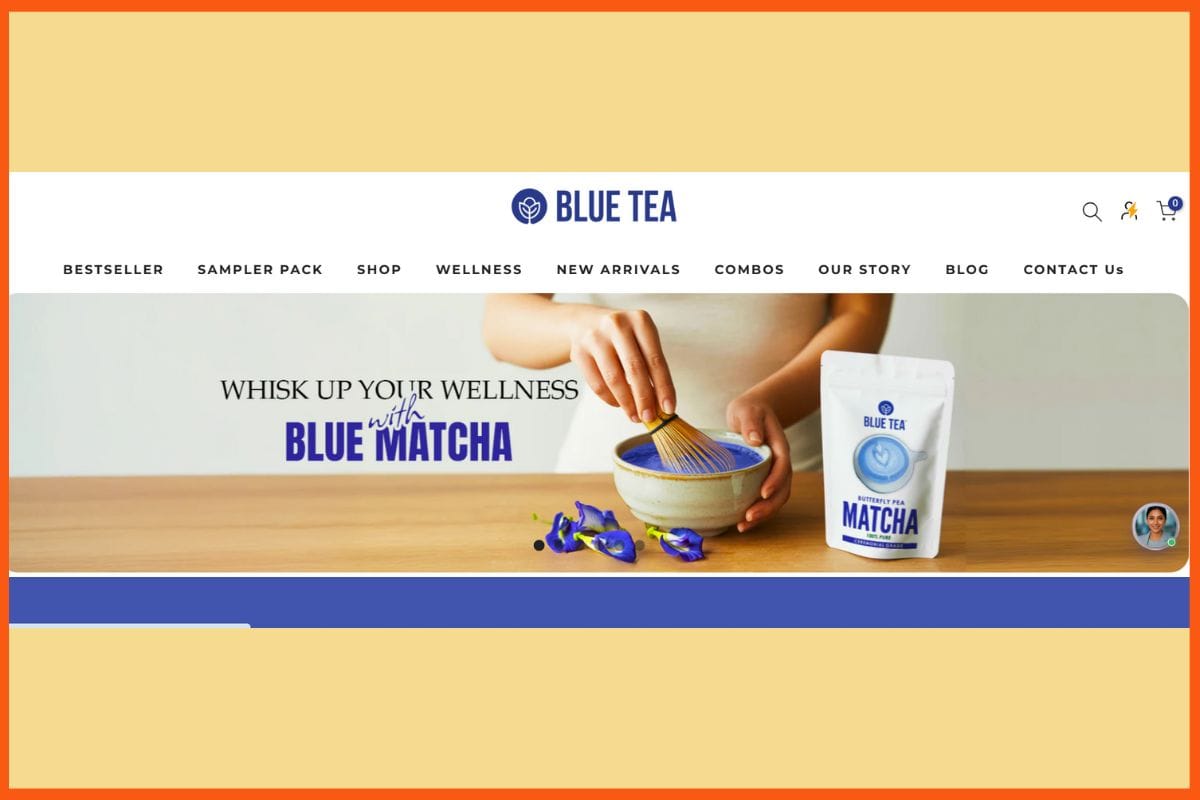

Blue Tea

| Year of Inception | 2020 |

|---|---|

| Founders | Nitesh Singh, Sunil Chandra Saha |

| Funding Raised | INR 50 lakh for 3% equity + INR 25 lakh debt (Shark Tank India S2) |

| Key Investors | Aman Gupta |

| Headquarters | Delhi |

Blue Tea brings ancient Ayurvedic flowers to modern cups, offering antioxidant-rich, caffeine-free teas from shankhpushpi and butterfly pea. For investors, it represents a unique farm-to-cup wellness beverage brand tapping into the rising demand for functional, natural, and holistic drinks in India.

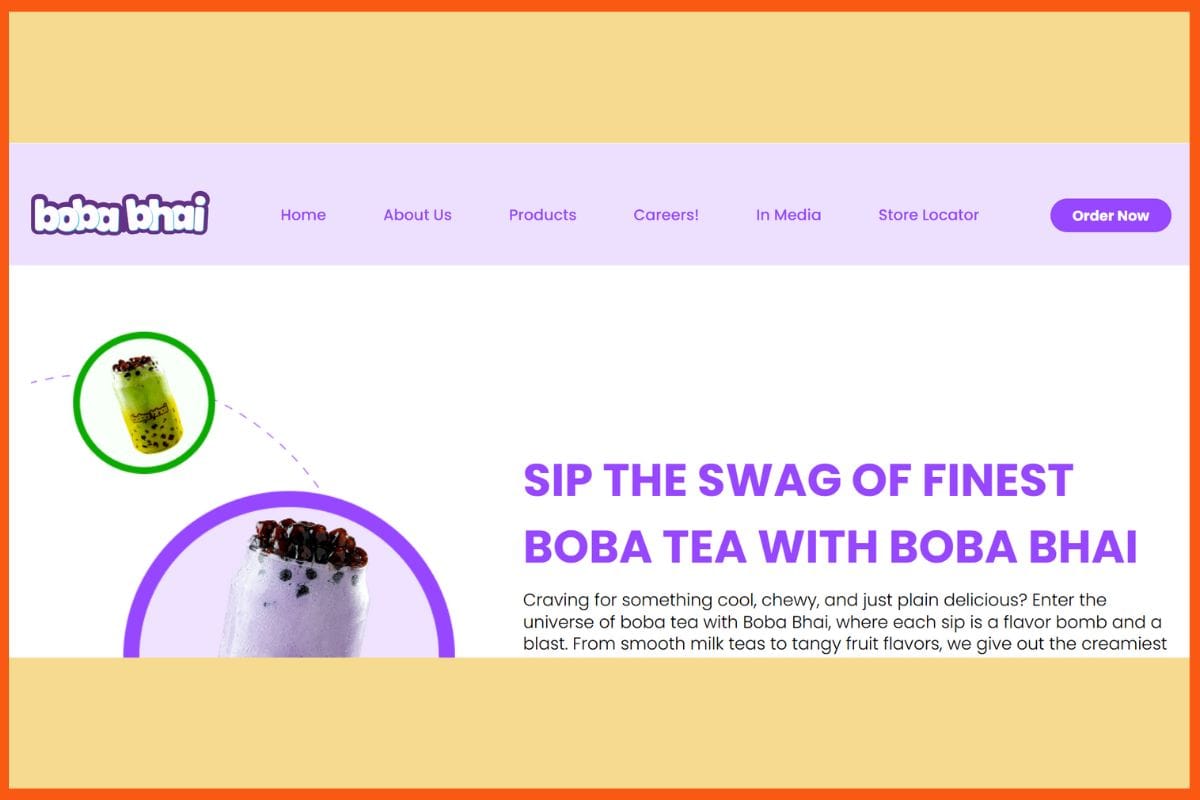

Boba Bhai

| Year of Inception | 2023 |

|---|---|

| Founder | Dhruv Kohli |

| Funding Raised | $3.35 Mn+ |

| Key Investors | Titan Capital, Arjun Vaidya, Varun Alagh |

| Headquarters | Bengaluru |

Boba Bhai has quickly emerged as a leading bubble tea brand in India, serving over 4 lakh customers in just one year with revenues of INR 8 Cr. For investors, it offers high-growth potential through aggressive expansion plans to 150 stores by 2025, new product launches, and strong traction in the urban F&B market.

Coolberg

| Year of Inception | 2016 |

|---|---|

| Founders | Pankaj Aswani, Yashika Keswani |

| Funding Raised | $3.5 Mn |

| Key Investors | RB Investments, India Quotient, Ashish Goenka, Indian Angel Network |

| Headquarters | Mumbai |

Coolberg offers a range of non-alcoholic beers and beverages, with distribution across India, Africa, the Maldives, Bhutan, and Nepal. For investors, it represents a premium, globally scalable beverage brand, strengthened by acquisition and poised for portfolio expansion in the non-alcoholic drinks segment.

StartupTalkyArchana Karthikeyan

StartupTalkyArchana Karthikeyan

DropKaffe

| Year of Inception | 2019 |

|---|---|

| Founders | Rakshit Kejriwal, Lakshmi Dasaka, Chaitanya Chitta, Amar Yashlaha |

| Funding Raised | $850 K |

| Key Investors | Fireside Ventures, Brigade Group, GrowthStory, Sidharth Pansari, Nirupa Shankar, Hitesh Oberoi, Kanwaljit Singh, Apurva Salarpuria, Manish Singhal, P39 Capital |

| Headquarters | Bengaluru |

DropKaffe offers ready-to-drink and fresh coffee products across 160+ locations in 19 cities, serving over 500K customers. For investors, it presents a fast-growing D2C and café brand in India’s booming coffee segment with strong urban penetration.

FOMO Iced Tea

| Year of Inception | 2022 |

|---|---|

| Founders | Avik Chaudhery, Gaurang Gadia |

| Funding Raised | INR 35 lakh for 6% equity (Shark Tank India) |

| Key Investors | Aman Gupta, Anupam Mittal |

| Headquarters | Mumbai |

FOMO Iced Tea targets Gen-Z and health-conscious consumers with zero-refined sugar beverages, combining trendy branding with functional benefits. For investors, it’s a youth-driven brand in India’s growing low-calorie beverage market.

CoCoFit

| Year of Inception | 2020 |

|---|---|

| Founders | Shashikant, Sunil Kumar |

| Funding Raised | INR 50 lakh for 1.67% equity (Shark Tank India) |

| Key Investors | Namita Thapar, Aman Gupta, Anupam Mittal |

| Headquarters | Bengaluru |

CoCoFit delivers farm-to-cup coconut beverages with no added sugar or preservatives, appealing to health-conscious urban consumers. For investors, it represents a premium, functional beverage brand with scalable farm-to-consumer operations.

Skippi Pops

| Year of Inception | 2020 |

|---|---|

| Founders | Ravi Kabra, Anuja Kabra |

| Funding Raised | INR 1 crore for 15% equity (Shark Tank India) |

| Key Investors | All 5 Shark Tank India investors |

| Headquarters | Delhi |

Skippi Pops revives the traditional “chuski” with preservative-free, all-natural ice pops, scaling nostalgia into a modern FMCG opportunity. For investors, it’s India’s first all-natural frozen treat brand with proven Shark Tank backing and growth potential.

Malaki

| Year of Inception | 2021 |

|---|---|

| Founders | Ashish Bhatia, Mohit Bhatia |

| Funding Raised | INR 50 lakh for 3% equity (Shark Tank India) |

| Key Investors | Aman Gupta, Peyush Bansal |

| Headquarters | Mumbai |

Malaki offers premium, non-alcoholic wellness beverages crafted with Himalayan ingredients and contemporary Indian flavours. For investors, it presents a luxury D2C opportunity in India’s growing artisanal and functional drinks segment.

Conclusion

The beverage scene in India is changing like never before. These startups aren’t just selling drinks; they are creating experiences, shaping lifestyles, and connecting with consumers in meaningful ways. From artisanal coffees and wellness teas to bubble teas and natural frozen treats, each brand reflects creativity, health focus, and a fresh approach to consumption.

For investors, the opportunity is clear: D2C models, strong urban adoption, innovative products, and the potential to scale make this sector incredibly promising. These 10 brands show how the Indian drink industry is evolving, offering both exciting growth for entrepreneurs and smart avenues for investment.

StartupTalkyPratyusha Srivastava

StartupTalkyPratyusha Srivastava

FAQs

Which are the top D2C beverage startups in India?

Some of the leading startups include Blue Tokai Coffee Roasters, Glow Glossary, Blue Tea, Boba Bhai, Coolberg, DropKaffe, FOMO Iced Tea, CoCoFit, Skippi Pops, and Malaki.

Why are Indian consumers shifting from traditional soft drinks to D2C beverages?

Consumers are seeking healthier, functional, and innovative alternatives such as cold brews, bubble teas, herbal infusions, and non-alcoholic beers instead of colas and packaged juices.

Which Indian D2C beverage startup focuses on nostalgia?

Skippi Pops is reviving the traditional “chuski” in a preservative-free, all-natural form, turning nostalgia into a scalable FMCG opportunity.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Startuptalky. All rights belong to the respective publisher.)