To say that Tata Steel is an Indian multinational and one of the most famous names in iron and steel exports would be an understatement. The birthplace of Tata Steel is not Mumbai, for that is where the Tata flagship was born; it rather spread its vast manufacturing bases far and wide from India to Europe and Asia. But then, one may cower before the dimensions of Tata Steel, in direct steel-making capacity scales of more than 35 million tons.

The major production centers in Jamshedpur and Kalinganagar are regarded as examples of operational excellence and quality in India. First in privately owned India to enter integrated steel manufacturing, Tata Steel fully undertook this process – from mining its raw materials to distributing high-end products. This example of integrated steel-making was fast-tracked and took place without any procurement from outside, thereby ensuring pure quality and consistency. Tata Steel, with over 78,000 employees spread throughout five continents, is aimed at addressing the ever-growing needs of countless industries from automotive to construction and infrastructure.

Tata Steel Business Model

How Tata Steel Makes Money I Revenue Model of Tata Steel

Tata Steel’s Unique Selling Proposition

Tata Steel’s SWOT Analysis

About Tata Steel

In that year of 1907, Tata Steel came into being and began forging the steel development, a process initiated by Jamsetji Tata and his son Sir Dorabji Tata, who were then observing a fracture that existed in the steel industry of India. Together, they resolved to position Sakchi-now Jamshedpur-among the very first integrated steel plants in India. The move was audacious and proved to be more prescient, as in 1912-the first steel ingot was cast by the company-within a year after the commissioning of its blast furnace. Along with development came the price; of course, money counted, and so did technology, but it was a long, arduous path, and saved by the local supporters ever – diligent investors.

During the First World War, Tata Steel was one of a major contribution to output that drove the war efforts and thus built up a considerable establishment as an industrial house. After having claimed industrial innovations by introducing the eight-hour workday in 1920-an extremely progressive step for India-performing even quicker on the uptake for innumerable lines of modernization info within the 1950s and beyond. Well into the new millennium, there have been rounds of global expansion by Tata Steel, with its last and most significant being the acquisition of Corus in the United Kingdom.

StartupTalkyDevashish Shrivastava

StartupTalkyDevashish Shrivastava

Tata Steel Business Model

Expectedly, Tata Steel claims to have a vertically integrated company, which takes care of the total steel value chain: from mines and raw materials extraction through to end-making and distributing different grades of steel products. The four pillars that characterize this integration are raw material security, cost competitiveness, and stringent quality checks, lending itself to being the world's most efficient steel producer. The automobile sector, the construction sector, agriculture, and engineering are some of the sectors serviced by Tata Steel, which has an established presence across five continents, most of which are the developing and developed markets. Profit sources are derived from conventional steel grades, advanced value-added products, and income from mining and consultancy businesses.

For the strategic competitiveness and adaptive sustainability of its business, Tata Steel keeps investing in research, digital transformation, and sustainability. The primary focus of Tata Steel in the past few years has been capacity building in India with the aim of improving customer deliveries, and investing in such technologies as Industry 4.0 and AI for optimizing operations and cutting costs. To further diversify the income streams, strengthen resilience against market movement, and consolidate leadership positioning within the industry, it is this very combination-global presence, innovation, integrated supply chain, and customer-centricity-that makes Tata Steel unique.

How Tata Steel Makes Money I Revenue Model of Tata Steel

Tata Steel's major steelmaking operations are located in India and Europe, with production and sales units also serving global commercial interests. Major contributions to its revenues include the supply of steel to the auto, construction, engineering, and infrastructure sectors. As per the consolidated financial statements in recent times, total revenues were soaring as a result of increased volumes in Indian deliveries and the sale of value-added products. The most voluminous contributions came from some of the principal plants at Jamshedpur and Kalinganagar, plus new business segments including commercial shipbuilding and advanced automotive steel.

The minor revenue contributions come from mining activities for iron ore and coal extraction, and certain utility and infrastructure activities. This full integration model has helped in maintaining cost efficiencies: revenue generation from exports and the consultancy division. With a strong focus on innovation, R&D investment incentives, progressively nurturing sustainability regarding income generation, agility associated with optimizing operational excellence, and discerning for excellent client service are the routes for constantly shaping revenue into margin augmenters.

| Year (Mar) | Total Revenue (INR Cr.) | Total Profit (INR Cr.) |

|---|---|---|

| 2025 | 1,34,763.56 | 13,969.70 |

| 2024 | 1,44,110.34 | 4,807.40 |

| 2023 | 1,32,332.10 | 15,495.11 |

| 2022 | 1,30,473.37 | 33,011.18 |

| 2021 | 84,888.03 | 17,077.97 |

| 2020 | 60,840.09 | 6,610.98 |

| 2019 | 73,015.79 | 16,227.25 |

| 2018 | 60,380.48 | 6,638.25 |

| 2017 | 48,407.48 | 5,356.93 |

| 2016 | 42,101.04 | 6,126.5 |

Tata Steel’s Unique Selling Proposition

Tata Steel defines its USP in an integrated way based on captive mining of iron ore and coal for quantity manufacture and marketing of finished steel products, such that raw material security, cost advantages, and control over quality make Tata Steel the most cost-efficient producer in Asia. Its diversified products cover almost every market-from automotive construction to agriculture-making revenue resilient over economic cycles. The company derives an excellent operational benefit from large-scale manufacturing with a near 100 percent capacity utilization in its flagship plants within India.

Tata Steel gets its strength from being present in more than 26 countries and from the goodwill and trust associated with the Tata brand. The clear presence of strong investments in technology and innovation and its sustainability path toward low-carbon steelmaking shape the identity of the enterprise, most notably in Europe, which has several strategic transformation programs specifically dedicated to ensuring its competitiveness in the market and environmentally conscious production. That's how Tata Steel's value proposition completes the story: strategic agility, financial resilience, and customer-centricity trend setter for future growth in high-end and emerging markets.

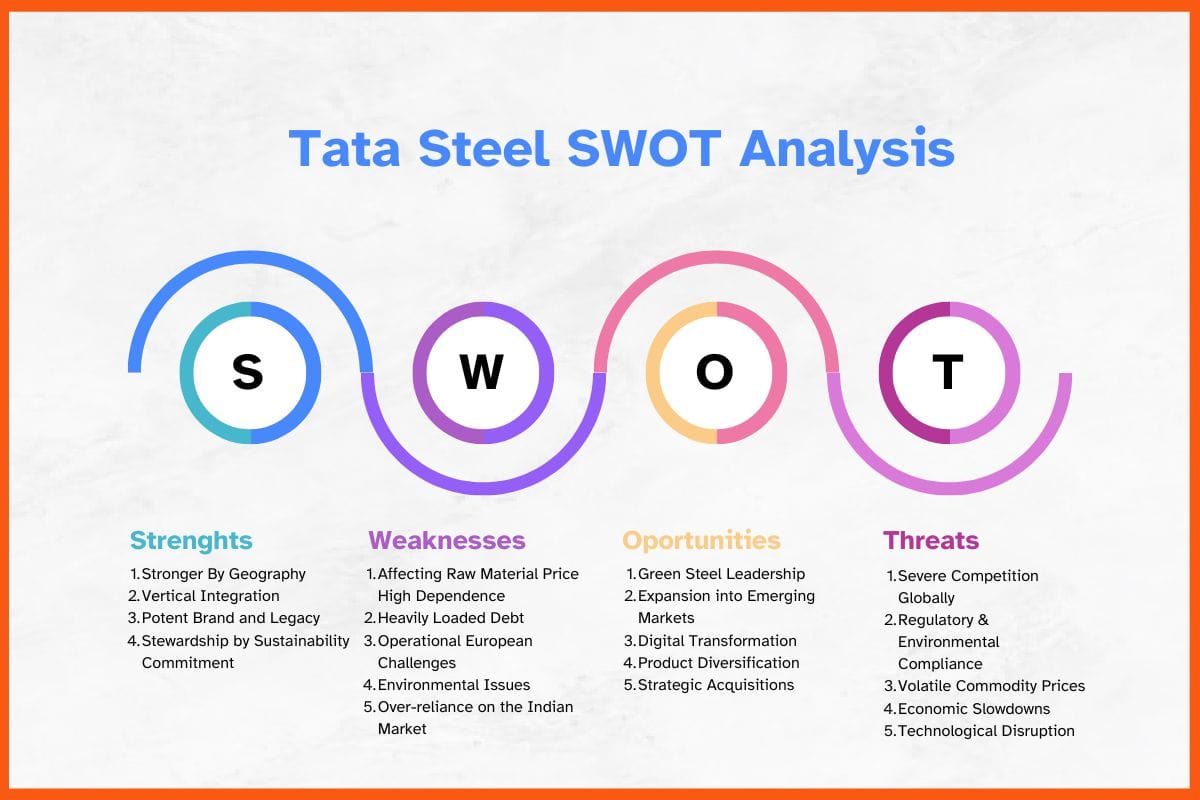

Tata Steel’s SWOT Analysis

Strengths

- Stronger By Geography: Operations in more than 26 territories provide different income streams to reduce dependence on any market.

- Vertical Integration: Control of mining, manufacturing, and distribution ensures cost efficiency and compelling quality.

- Potent Brand and Legacy: Tata Steel has received lots of trust in the Tata brand, whose over-a-century-old industry leadership benefits it.

- Stewardship by Sustainability Commitment: Quickly shifted toward low-carbon steel and using green technologies that would heighten its image, especially across Europe and India.

Weaknesses

- Affecting Raw Material Price High Dependence: Changes in price affect ore, iron, and coal, which affect profitability because of price movements.

- Heavily Loaded Debt: Debt has increased due to its past acquisitions, particularly within Europe.

- Operational European Challenges: Increased costs and issues of integration further impact profitability within these units.

- Environmental Issues: Steelmaking is still carbon-intensive, with a constant need for investment to comply with regulatory standards.

- Over-reliance on the Indian Market: The share is quite high for domestic demand in terms of revenue, thus being vulnerable to the market downturn.

Opportunities

- Green Steel Leadership: Investments in carbon-free and circular production technologies could place Tata Steel as the frontrunner in sustainable manufacturing practices among the industry.

- Expansion into Emerging Markets: The urbanization and construction boom in Southeast Asia and Africa offer huge growth potential.

- Digital Transformation: Cost efficiency is increased, coupled with superior supply chain management through AI, big data, and process automation.

- Product Diversification: Specializing in steel for EVs, renewable energies, and specialized applications will also improve margins.

- Strategic Acquisitions: Growth through mergers and acquisitions, and new partnerships to use technologies and the market.

Threats

- Severe Competition Globally: Bulge rivals like ArcelorMittal, JSW Steel, POSCO, and Nippon Steel put big pressure on prices and threaten their market portions.

- Regulatory & Environmental Compliance: The costs of compliance are still racking up high bills as they move toward being ‘green’.

- Volatile Commodity Prices: Iron ore and coal prices continue to prove very volatile, and this can sooner or later eat heavily into profits.

- Economic Slowdowns: They are very sensitive to cycles of global recession and domestic downturn in the construction and especially automotive sectors.

- Technological Disruption: Innovations using alternative materials or production methods could potentially reduce the steel demand of certain applications.

Conclusion

Tata Steel is a vertically integrated company, meaning it controls the entire value chain of steel production from mining to the production of finished goods. This structure affords it cost efficiency, quality assurance, and insulation against supply chain disruptions. An advantage of global deployment in so many products is serving so many different industries that Tata Steel will not be beholden to any one market. Investments in technology, digitalization, and sustainability are continuous in order to keep this company competitive, and value addition keeps the margins healthy. Added to this are the trust held by the Tata brand and the strategic evolutionary adaptability of the company, both of which will assist the firm in mitigating market volatility and achieving long-term growth in this global steel industry.

StartupTalkyVivek Dev Jacob

StartupTalkyVivek Dev Jacob

FAQs

What is Tata Steel ?

Tata Steel is an Indian multinational steel manufacturing company.

Where is Tata Steel headquartered?

Tata Steel is headquartered in Mumbai, India, with major production centers in Jamshedpur and Kalinganagar.

When was Tata Steel founded and by whom?

Tata Steel was founded in 1907 by Jamsetji Tata and Sir Dorabji Tata, establishing one of India’s first integrated steel plants in Jamshedpur.

How does Tata Steel generate revenue?

Tata Steel earns revenue through the sale of steel products, mining operations, consultancy services, and exports, with significant contributions from its Indian operations and global plants.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Startuptalky. All rights belong to the respective publisher.)