This article has been contributed byMr. Nagabhushana Reddy, Founder & Managing Director, NBR Group

If you need to know India's residential cycle in late 2024–2025, track the money—and currently, the money is moving into luxury and high-end homes in the metros. From Mumbai's record ticket sizes to Bengaluru's growth corridors, high-end projects are supporting overall sales values while volumes temper from last year's highs. The key question is if this top-heavy push can carry industry momentum up to 2026.

The Premium Engine Under the Hood

New information in ANAROCK's quarterly Pan-India Residential Market Viewpoints shows a changing market. During Q2 2025, sales volumes in the top seven cities decreased by 20% year-on-year to approximately 96,300 units. However, aggregate sales value crept higher by 1% to INR 1.47 lakh crore—plain proof of customers upgrading. Average prices went up 11% y/y, with Bengaluru improving by 12% and NCR rising by 27%.

Luxury (INR 1.5–2.5 crore) and ultra-luxury (>₹2.5 crore) markets are progressively on top. In Q2, luxury alone represented 27% of fresh supply, whereas ultra-luxury contributed another 19%. This skew wasn't new. Even in Q1 2025, the two combined represented 42% of launches in the leading seven cities, whereas affordable supply dwindled to merely 12%. Developers are consciously focusing on more margin-sensitive projects for buyers with deeper pockets.

Even while unit sales cooled, prices kept going up—up 17% y/y in Q1, driven by Bengaluru and NCR. And it is no "price illusion." Pre-sales market-wide reveal real traction: listed builders recorded historic pre-sales of over INR 1.6 lakh crore in FY25, and in Q1 FY26 alone, the top 10 players booked over INR 44,000 crore—close to 30% of their full-year goals in just one quarter.

Mumbai and NCR are still leaders in absolute terms, but Bengaluru leads the way in consistency. The city not only achieved double-digit price appreciation but is also seeing high-end launches pouring in across Sarjapur, Whitefield, and North Bengaluru. Backed by IT-driven job centers and planned metro and road corridors, Bengaluru's premium demand appears less cyclical and more structural—directly linked to increasing incomes and continued white-collar job generation.

Why Premium Is Winning: Incomes, Aspirations—and Credibility

Three factors account for the outperformance of premium housing:

- Increasing upper-middle and HNI incomes:- Growth in the formal sector, technology-enabled employment, and stock-market wealth impacts have increased the number of potential buyers willing to stretch for INR 1.5–INR 5 crore homes. Even as sales volumes ease, realizations remain intact because the buyer mix is becoming richer. Bengaluru, with its IT and startup wealth clustering, is a classic example of this trend.

- Execution credibility of Grade-A developers:- Following years of consolidation, customers are rewarding builders with credentials, open RERA-compliant procedures, and timely delivery. Top-end buyers, above other groups, crave brand trust—having faith that their investments would deliver what was warranted.

- Product-market fit:- Contemporary high-end apartments are sold less as bigger houses and more as holistic lifestyle offerings: private clubs, concierge, managed facilities, and security. Launches are being planned by developers to address this need, and that is why luxury and ultra-luxury supply stakes have remained elevated up to 2025.

StartupTalkyMuskaan Kapoor

StartupTalkyMuskaan Kapoor

Metros in Focus—and Bengaluru's Sarjapur Story

Demand for premium is still metro-focussed. ANAROCK data indicates MMR, Pune, Bengaluru, and NCR collectively contributed ~79% of sales in Q2 2025 and equally disproportionate share of new launches. Prices have grown steepest where employment and infrastructure are clustered, as expected.

In Bengaluru, Sarjapur Road-Gunjur has evolved into a marquee destination. An ANAROCK micro-market report (Jan 2025) points to the recipe: location near Outer Ring Road IT corridors such as Bellandur and Eco Space, access to Whitefield and Electronic City, and a list of mobility improvements in the pipeline such as the ORR Metro (Phase 2A, by 2026), Sarjapur–Hebbal Metro (Phase 3A, by 2031), and the Peripheral/ Satellite Town Ring Roads.

As of Q3 2024, the average price in Sarjapurroad-Gunjur stood at ~₹9,700/sq ft, registering ~62% appreciation over 2018. The micro market experienced a lean nine-month inventory overhang and a budget mix moving steadily upwards. Between 2018 and Q3 2024, Sarjapur supplied 31% of East Bengaluru's residential supply, and in 2024 alone, contributed 23% in just the first three quarters—a testament to enduring developer conviction.

Premium Housing: Momentum with Caveats

Premium demand continues to anchor India’s real estate values, even as overall unit sales are moderate. Stable jobs, urban wealth creation, and disciplined execution have kept prices firm, inventories declining, and pre-sales visibility strong. Metro micro-markets like Bengaluru’s Sarjapur belt and Hebbala Extension remain resilient demand pools that cushion the cycle.

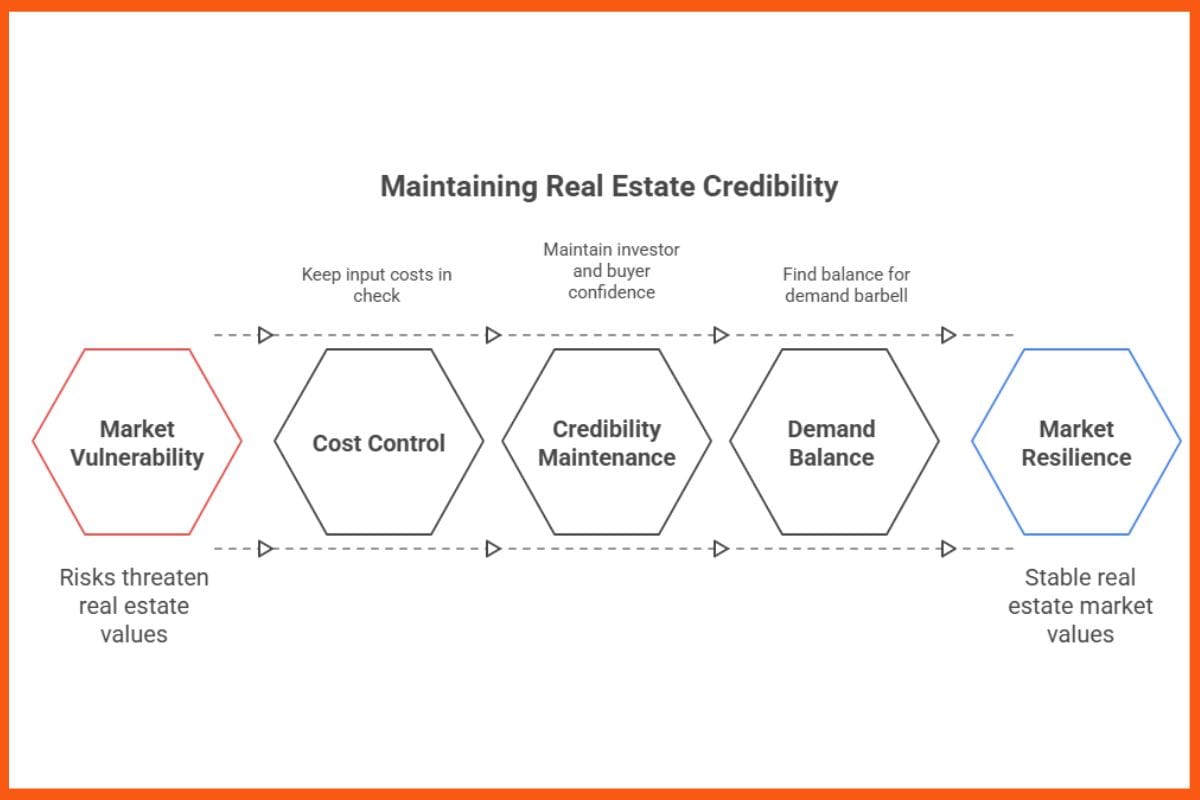

Still, there are risks. Input costs drive developers towards higher-ticket launches, international uncertainty can subdue NRI and HNI buying, and lapses in execution could undermine investor confidence. At the same time, slender affordable supply exposes weakness should wage growth stall or mortgage rates increase. The sector's direction depends on maintaining credibility, keeping costs in check, and finding the right balance for the demand barbell.

Bottom Line

India's housing market has turned firmly from a volume-driven to a value-driven era, with high-end and luxury projects driving the cycle. The evidence—firming prices, buoyant sales values, and healthy pre-sales by top developers—points to this motor being able to continue running.

But to maintain momentum into FY26 will mean doubling down on two essentials: execution credibility (prompt delivery, clear specifications, and good post-handover services) and capital discipline (capital-led launches, sensible pricing). Provided developers deliver on these terms—and provided infrastructure keeps sewing India's jobs nodes and residential corridors together—micro-markets such as Bengaluru's Sarjapur will continue to anchor the upmarket narrative while absorbing cyclical shocks.

That is, premium can pass the baton, but only if the ending is as reliable as the beginning.

StartupTalkyMahenoor Mansuri

StartupTalkyMahenoor Mansuri

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Startuptalky. All rights belong to the respective publisher.)