India’s manufacturing push is gradually bearing fruit, if the drone tech ecosystem’s role in Operation Sindoor is any indication.

In what was the first ever full-fledged drone war between India and Pakistan, India’s homegrown technologies and startups — ranging from advanced drones and guided munitions to air defence systems — played a pivotal role in both offensive strikes and defensive actions.

Following the conflict, the central government issued statements praising the performance of indigenous high-tech systems. Particular emphasis was given to the role of Drone Federation India (DFI), and drone tech startups like IG Drones, Paras Defence & Space Technologies, Tata Advanced Systems, and Alpha Design Technologies.

While strategic policy moves, including the 2021 ban on drone imports, have helped nurture the sector, experts believe that this real-world showcase of power now marks a turning point for the industry. The opportunity for Indian companies to prove themselves in live conflict scenarios is expected to unlock significant growth and global relevance for the country’s drone tech ecosystem, they say.

“Military conflicts always accelerate the development of critical technologies. It was significant for India that during a serious conflict like the recent Indo-Pak war, we didn’t have to run helter-skelter to procure drones from other countries. Both in the drone and counter-drone domains, the country could clearly showcase the effectiveness of its indigenous design and manufacturing capabilities,” DFI president Smit Shah told Inc42.

Overall, the industry expects faster iterations of drone tech and delivery of upgraded technologies. Shah added that procurement time by the government is expected to get faster, the R&D funding is expected to increase, along with some other key developments in critical areas.

He also told Reuters earlier that the country might now invest heavily in local industry and could spend as high as $470 Mn on UAVs over the next 12 to 24 months, which is almost 3X the pre-conflict levels.

As a result, this event is also expected to boost private funding for the drone industry.

While the defence-focussed drone tech startups often faced hurdles in raising funding from the VCs due to the lengthy and strenuous government tendering process, they believe that after Operation Sindoor, the way private investors view defence investment will also see a shift.

India’s Drone History

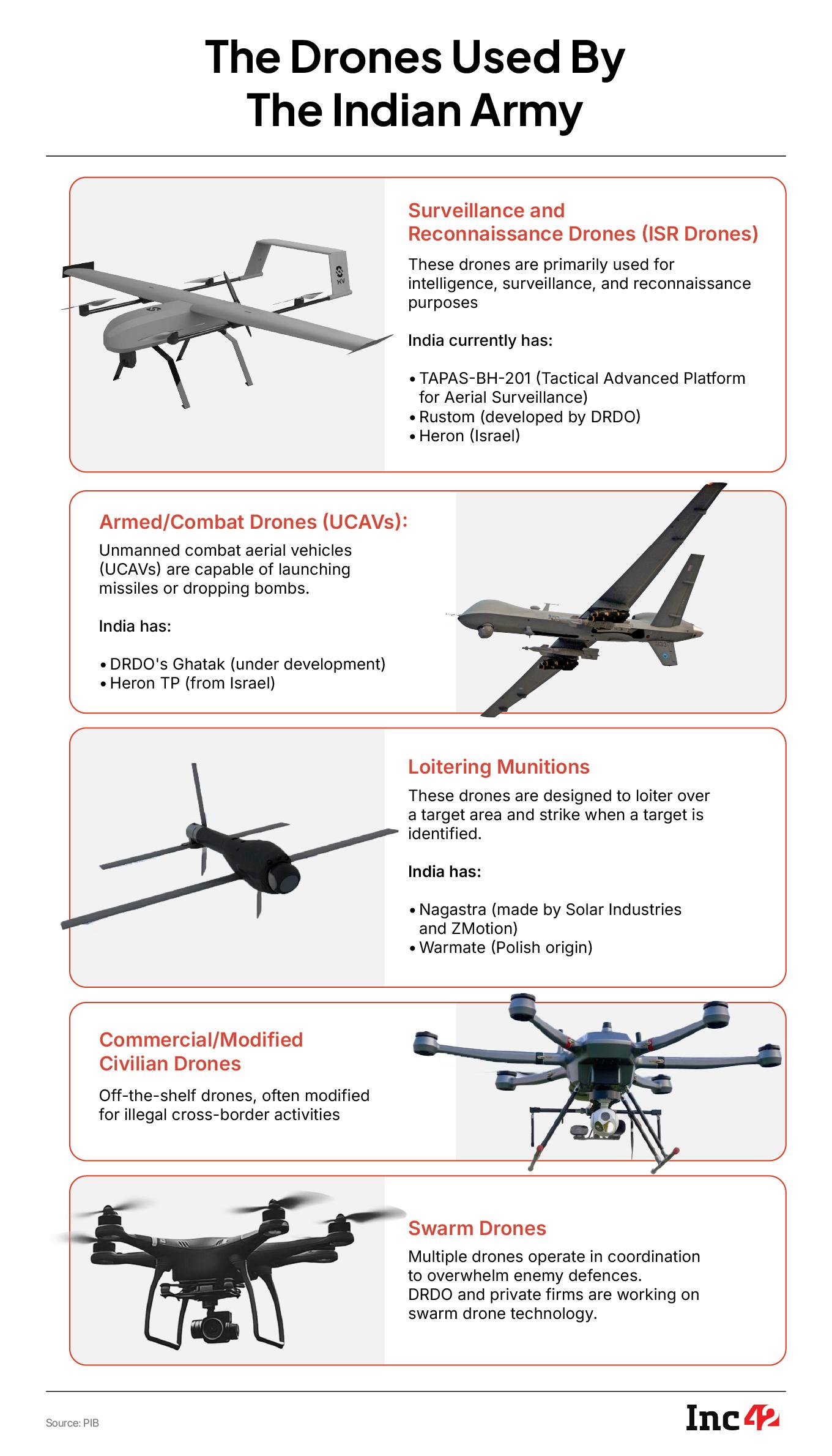

The usage of unmanned aerial vehicles (UAVs) or drones in military operations can be traced back to the 19th century and the First World War. Ever since, various types of drones have been used in global wars.

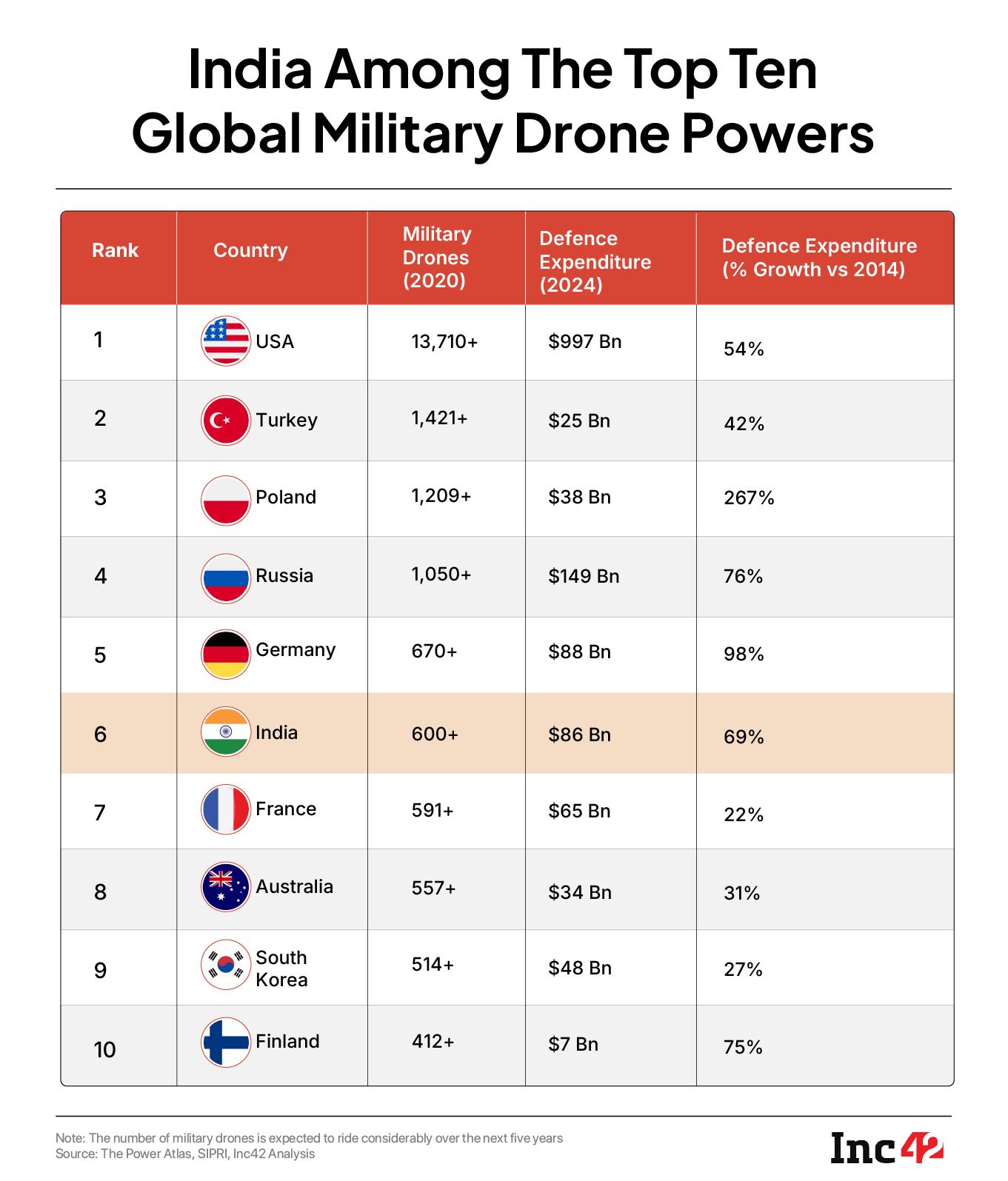

In fact, India first deployed its military drones during the 1999 war with Pakistan, using Israeli-supplied IAI Heron and Searcher drones.

However, drones in their newest avatars, with cutting-edge AI, robotics, and other technology capabilities, are not more than a decade old. Besides, even as drones found their largest use in India in military operations from the very beginning, they were imported for the longest time.

In recent years, with the emergence of the likes of ideaForge, NewSpace Research, Garuda Aerospace, Asteria Aerospace, among several other startups as well as legacy companies like Paras Defence & Aerospace, Adani, Tata, and others beginning drone and drone component manufacturing, Indian government has started procuring UAVs from these companies too.

The role of the Defence Research and Development Organisation (DRDO), Bharat Electronics Limited (BEL), and Hindustan Aeronautics Limited (HAL) has also been crucial in indigenous drone manufacturing.

Though some of these companies also work under international joint ventures, the reliance of the Indian armed forces on India-designed or India-manufactured drones has strengthened the broader hardware ecosystem associated with UAVs.

As per government data, the Indian drone market is projected to reach $11 Bn by 2030, accounting for 12.2% of the global drone market, with use cases spanning across defence, agriculture, logistics, and other commercial sectors. While the Centre has not explicitly noted the growth expected in military drones, many reports suggest that defence will comprise the biggest portion of this market.

Though defence use cases of drones were largely limited to surveillance so far, the requirements are evolving fast and drones are being deployed to counter enemy drones, launch missiles and drop bombs, and even for post-strike damage assessment and evacuation. Operation Sindoor is a striking example of this.

As per government data and various reports, Indian armed forces used Nagastra drones, made by Nagpur-based Solar Industries and Bengaluru-based ZMotion; Rustom, a medium-altitude long-endurance (MALE) UAV developed by DRDO; Polish-origin WARMATE; SkyStriker drones, jointly developed by Israel’s Elbit Systems and Alpha Design Technologies, among many others in the warfield this time.

Besides, IG Drones has also received significant attention following the conflict.

Sambit Parida, cofounder and CTO of IG Drones, told Inc42 that it started working with the Indian army around 2023 to first understand the military requirements. It’s been about a year now since the startup began delivering its drones to the armed forces.

“We have already provided the Indian armed forces with IG Drones’ flagship vertical take-off and landing (VTOL) SKYHAWK and IG Drones JAGA. From kamikaze (suicide drones) to surveillance, our drones are capable of multiple use cases,” Parida said.

He declined to comment on the exact areas where its drones were used during Operation Sindoor, citing possible threats to the intelligence. “Following the kind of success we and others peers in the industry have shown during the recent Indo-Pak conflict, we are already expecting more government orders,” the IG Drones founder added.

Operation Sindoor: A Boost To Drone Tech?

As per the Centre’s data, today 65% of defence equipment is manufactured domestically in contrast to 65-70% import dependency earlier.

However, during Inc42’s interaction with multiple startups and VCs in the Indian defence and drone ecosystem, we found that the biggest hurdle to its growth has been the long L1 tender processing time by the government and hence, the uncertainties that loom around revenue generation.

While many see it as an adversity for the startups trying to build their business, betting on the country’s defence requirements, some experts are also of the opinion that the stringent process actually filters out the best, given that defence has no place for error. Most, however, believe that Operation Sindoor, along with some other steps taken by the government, will change the game.

According to Manu Iyer, general partner and cofounder of Bluehill VC, a deeptech and defence-focussed fund, the over-dependence on the government-based orders and their long gestation cycles of procurement and payment have been a challenge for startups and VCs in defence.

However, he said, that two things have moved the needle on this front – the neat conception and execution of the IDEX (Innovation for Defense Excellence) program and the 2023 Memo from the Ministry of Defense that no “Global Tender Enquiry” shall be invited for tenders up to INR 200 Cr, further boosting the development of local sourcing and supply chain.

“Given these developments and the potential of large outcomes, VCs cannot be far behind… Additionally, the out-performance of defence stocks like Data Patterns, Zen Technologies, and Astra Microwave, in the public markets, has shown that large exits via public listings are possible, which is another factor that will now play into VC interest,” he said.

Iyer believes that the superlative performance of locally developed technologies like Akashteer air defence system, NAVIC Global Positioning System, Loitering Munition Systems and the Brahmos Missile systems during the war will go a long way in giving confidence to the military establishment in procuring further locally developed systems attracting more players to build and showcase indigenously developed technologies for deep application and integration into our defense systems.

The founder of a drone startup closely working with the Indian army told Inc42 that Indian VCs have been largely sceptical about investing in defence-focussed drone startups, considering the delays with government orders.

“If you look at one of our listed peers (referring to ideaForge), their revenue forecast has often gone haywire due to delays in government orders or the tendering process taking longer. It took a hit on their quarter-on-quarter revenue as well even as the company also does civil drone deployments. So, investors often see valid reasons not to invest if you are a drone startup solely dependent on defence,” the person said.

However, IG Drones’ Parida said that government orders, especially in defence, take a longer time because of stringent quality checks.

“The Indian government has become extremely focussed on giving orders to the Indian companies, including startups, but they are very stringent about quality checks and Make In India products. During a commercial deployment, if my drone runs out of charge mid-way while we are piloting a 100 km survey, we can restart it once the drone is back in action. If the same incident happens during a pilot for defence, the drone will be rejected right away,” he said, stressing the need for startups also to buckle up.

It is pertinent to note that drones, like most other electronic goods, have largely been dependent on imported components or imported finished products from China. Amid the country’s strict regulations in 2022 banning the importing of drones in CBU (completely built up), CKD (completely knocked down), or SKD (semi knocked down) forms, many drone startups began manufacturing in-house. However, the supply chain has continued to remain an issue.

Even today, most Indian drone startups are dependent on other countries, including China, to import at least the batteries, motors, and chips.

The government continues to keep the industry under thorough checks and balances on the extent to which imported components are being used, say the industry leaders.

Ashutosh Baheti, CEO of Paras Anti Drone Technologies, which provides anti-drone systems to the Indian army, also said that the long cycles in defence are equally true across the world.

“However, the process is improving. More visibility is coming to the Indian startups that are building the technologies independently. After Operation Sindoor, more companies are coming forward with their indigenous solutions, and they’re also being appreciated and asked to provide trials by the government,” he said.

In fact, after the recent conflict, Paras is doubling down on its anti-drone systems to make them more advanced.

“This phase has taught us the need for the evolution of defence technology, and what exactly needs to be done to shift from conventional systems to systems that are more agile, scalable, and manoeuvrable with respect to threat assessment and the emergence of different drones in the market used by other countries,” Baheti said.

So, What’s Next?

While the Indian government has taken multiple measures in the last few years to boost the drone tech ecosystem, from the Drone Policy 2021 to PLI for drone manufacturing, the industry is still in need of more.

Especially after the kind of capability that Indian companies showed on the battlefield, DFI’s Shah said that the industry body wants to work further with the Indian government to develop a more robust technology development roadmap, supply chain auditing and diversification processes, and to boost the R&D funding.

“We would like to work with the government to create a technology development roadmap that has a more realistic timeline so that industry is better prepared in the time of contingency. Besides, more R&D funds should be deployed on various technologies and areas like jamming-proof technology segments and various types of payloads that are important for offensive missions,” Shah said.

“So far, our drones have been deployed only in some counter-terrorism operations or counter-insurgency operations and peace-time border patrolling. Now, for the first time, we have seen the deployment of drones in a fully declared offensive situation. This area needs more focus.”

Shah also reiterated that while defence always had a very slow product-to-payment cycle, it is expected to change now, as the fifth Indo-Pak war has taught the country many lessons.

“Drone companies usually make a product and then do the field trials and customer evaluations for about one to two years. Then a procurement is initiated, which gets closed in about one to two years, and then another one year is taken in product delivery… After Operation Sindoor, some production cycle will continue throughout the year.”

As per publicly available data, currently, at least 80 tenders are under process that have been floated by the Indian Army this year to procure a range of UAVs—from swarm drones to surveillance drones.

As drones become increasingly sophisticated worldwide with advancements in AI, India must continue to strengthen its indigenous technology to stay ahead. While considerable strides have been made, the journey is far from over. The real test will be whether India can leverage these advancements to outpace its adversaries in future conflicts and protect its borders with minimal casualties.

[Edited By Nikhil Subramaniam]

The post Will Operation Sindoor Propel India’s Drone Tech Ecosystem? appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)