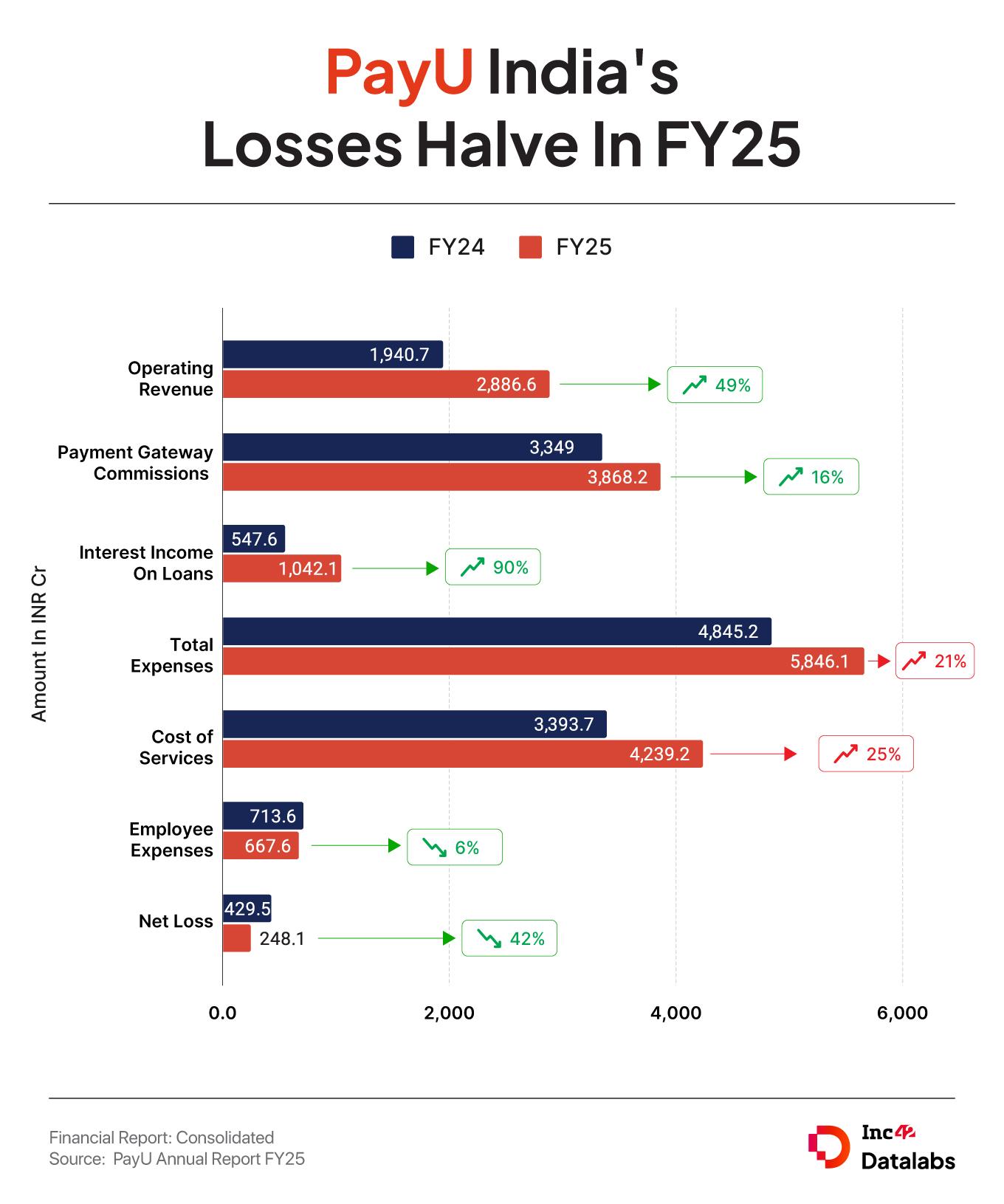

Prosus-owned fintech major PayU India managed to cut its net loss by 42% to INR 248.1 Cr in FY25 from INR 429.5 Cr in the previous fiscal, on the back of strong business growth and tax credit.

The company’s operating revenue surged 23% to INR 5,563 Cr during the year under review from INR 4,527.9 Cr in FY24.

Besides the growth in the top line, the bottom line was also helped by changes in tax outgo. PayU India received a tax credit of INR 1.6 Cr in FY25 as against a tax expense of INR 156.1 Cr in FY24.

Including other income of INR 33.5 Cr, the fintech’s total income shot up 22% to INR 5,596.5 Cr in FY25 from INR 4,575.4 Cr in the previous year.

Where Did PayU India Earn From?

The company earned the biggest chunk of revenue from the payment gateway commission it charges from merchants to facilitate digital payments. This commission rose 16% YoY to INR 3,868.2 Cr.

Meanwhile, the company’s credit business saw its interest income on loans surge past the INR 1,000 Cr mark in FY25. It zoomed over 90% YoY to INR 1,042.1 Cr.

The strong growth in the company’s credit offerings, which is housed under subsidiary LazyPay, can be linked to two major developments:

— In August 2024, it partnered with Amazon Pay to offer online merchants “instant, flexible and convenient credit options to their customers”

— In June 2024, LazyPay partnered with Blinkit to facilitate its users with one tap mobile payments

To further boost its credit business, Prosus invested INR 302 Cr in the company in July 2025. PayU India then said that the capital will be used for the growth of its credit business which is expected to breakeven by September 2025.

Further, service and fee income from digital financial services business grew 29% YoY to INR 130.3 Cr in FY25, while commission income slid 3% to INR 24.1 Cr.

Where Did PayU India Spend?

PayU India’s expenses during the year under review jumped 21% to INR 5,846.1 Cr from INR 4,845.2 Cr in FY24.

Cost Of Services: This expense head, which accounts for all the services that PayU India provides, saw a 25% YoY increase to INR 4,239.2 Cr. While expenses for its payment gateway increased 15% YoY to INR 3,387 Cr, borrowings for finance business surged 110% YoY to INR 326.2 Cr.

Employee Expenses: The company’s spending on its employees declined 7% to INR 667.6 Cr in FY25. Under this, the salaries it paid to employees increased 11% YoY to INR 614.3 Cr. The overall decline under this head was due to a gain of INR 132.8 Cr on account of remeasurement of share based compensation. This amount stood at INR 35.4 Cr in the previous fiscal.

Impairment Loss: The company’s impairment expenses stood at INR 462 Cr, jumping 61% from INR 286.8 Cr. Write-offs surged 81% YoY to INR 350.3 Cr.

This comes at a time when the company is preparing for its IPO. However, it is important to note that the fintech major has been discussing its public listing plans for some years.

In 2023, PayU was planning to file its DRHP but postponed it to 2025. Later, the company was said to be eyeing a public listing in FY26 but it has been deferred again.

Earlier this week, it was reported that the company is eyeing raising $250 Mn to $300 Mn (about INR 2,200 Cr to INR 2,640 Cr) ahead of its public listing to diversify its shareholder base.

The post PayU India FY25: Loss Down 42% YoY To INR 248 Cr, Top Line Zooms 23% appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)