Over the past few years, Nazara Technologies has had an aggressive run of acquisitions, especially in gaming IPs. While analysts had their reservations about its unabated expansion spree, the gamble seems to be paying off.

In the first quarter (Q1) of financial year 2025-26 (FY26), Nazara posted a net profit of INR 51.3 Cr, up 117.6% year-on-year (YoY). Sequentially, the metric is up a whopping 1,183% from INR 4 Cr. Operating revenue doubled to INR 498 Cr during the quarter under review from INR 250 Cr in Q1 FY25. However, revenues declined a mere 4.1% from INR 520 Cr in Q4 FY25.

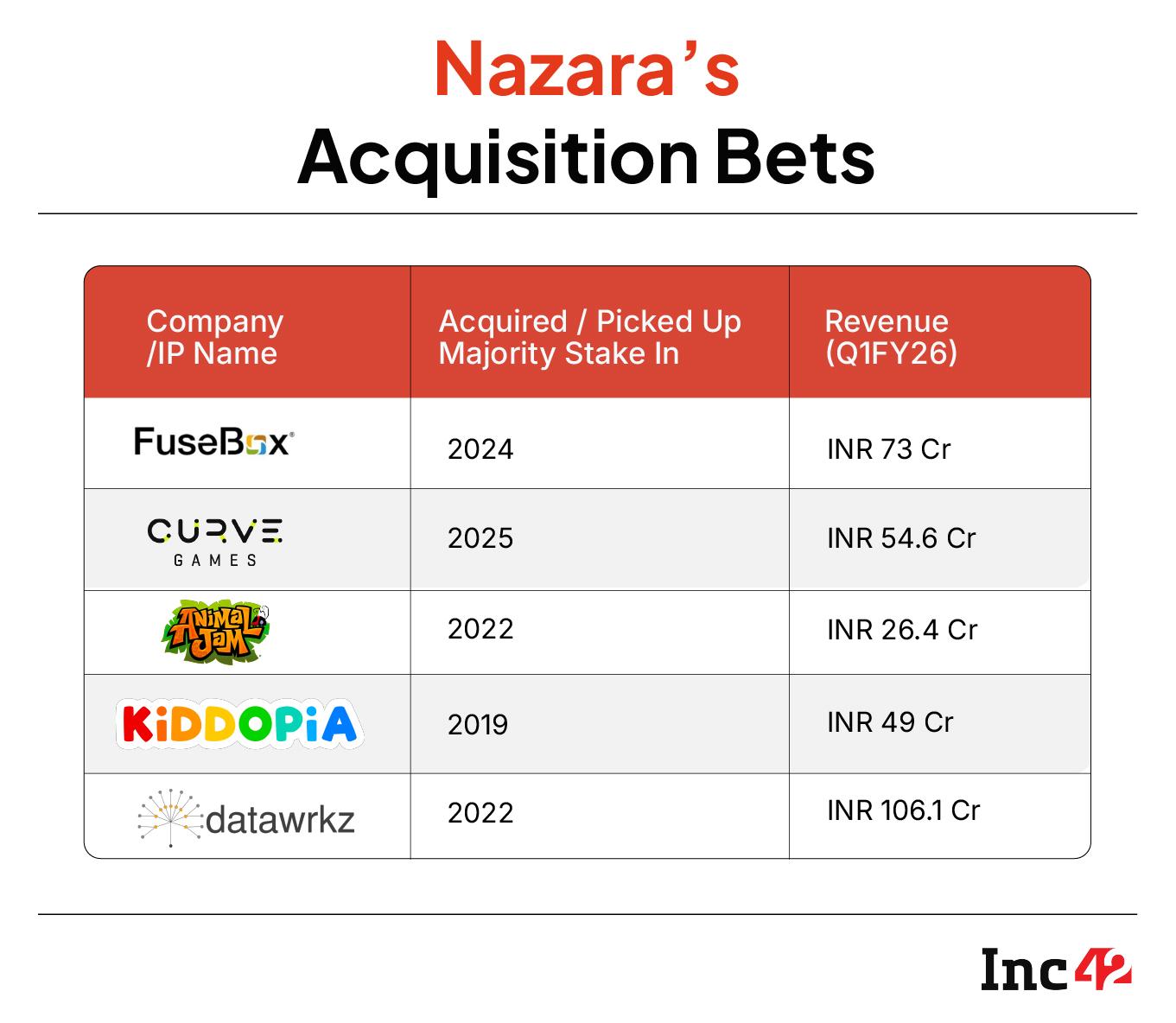

Key areas, including gaming and adtech, benefited from Nazara’s aggressive global expansion and IP portfolio building. The company attributed the strong performance to titles like Fusebox, Animal Jam, and Curve Games, all acquired in the last three years. Besides acquisition-led growth in gaming, adtech also contributed to the performance.

“We are seeing early results from our sharpened focus on IP-led gaming and are reinvesting this momentum into expanding our IP portfolio and strengthening the company to drive sustained growth,” joint MD & CEO of Nazara Technologies Nitish Mittersain said during the Q1 earnings call.

However, while its results appear to validate its IP-led gaming focus, sustaining this growth will hinge on the company’s ability to keep monetising these assets.

IPs That Drove Nazara’s Gaming Revenue In Q1

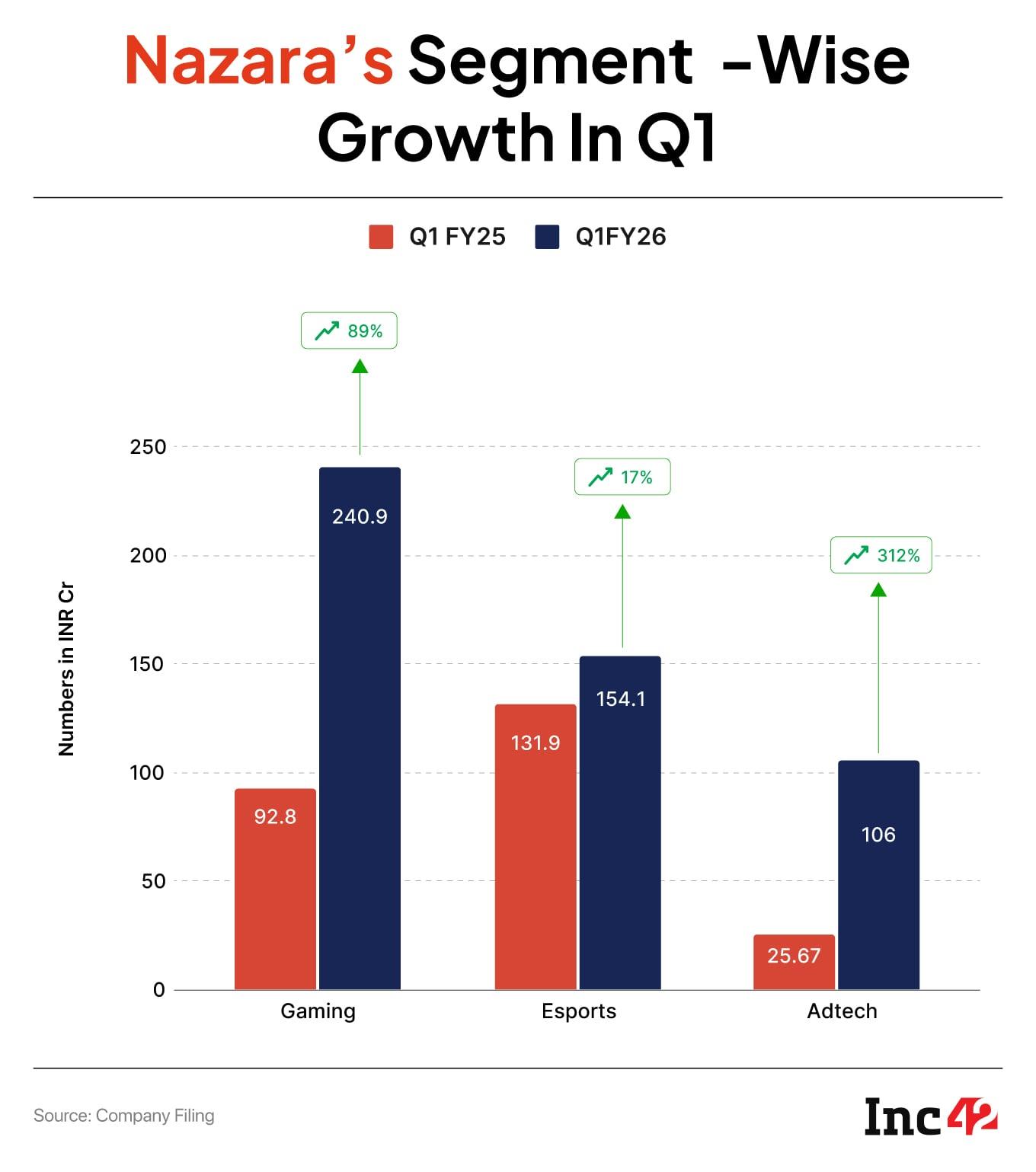

Nazara’s gaming segment saw a big YoY jump of nearly 160%, from INR 92.8 Cr in Q1 FY25 to INR 241 Cr in Q1 FY26. The segment, which has often been the most volatile in its portfolio, delivered a near threefold increase in revenue, thanks to a mix of strategic bets, global expansion, and a more diversified IP slate.

The biggest needle mover proved to be the acquisition of Curve Digital Entertainment Ltd. (CDEL), a UK-based publisher of premium PC and console games, in April 2025.

CDEL’s addition was not just about portfolio size — it opened up access to a high-value segment where the average revenue per user (ARPU) far exceeded those in mobile casual gaming. Curve was consolidated into Nazara’s books in Q1 FY26 and has already contributed INR 54 Cr in revenue, making up 22% of the total gaming revenue.

Another big acquisition, Fusebox, generated a substantial amount of revenue in Q1. Acquired in 2024 for an all-cash deal of INR 228 Cr, UK-based Fusebox Games’ Q1 FY26 revenue stood at INR 73 Cr, compared to INR 49 Cr a year ago.

Nazara has a long-term game plan for Fusebox, which has transformed from a single-game studio at the time of Nazara’s investment into a full-fledged multi-game operation. This year, the studio released a new title based on the Big Brother IP, expanding its reality TV portfolio beyond Love Island: The Game. It will launch a Big Boss-themed game this year and follow up with another title next year, the company said in its investor presentation.

While its early bets Kiddopia and Animal Jam did not show much growth, adtech acquisition played along,

In 2022, Nazara acquired a majority stake in Datawrkz, a programmatic advertising and monetisation company. In 2024, Datawrkz picked up a 100% stake in a UK-based growth marketing agency, Space & Time.

On a consolidated basis, Datawrkz’s revenue, including Space and Time, has seen a massive 313% YoY growth to INR 106.1 Cr in Q1 FY26, compared to INR 25 Cr in the corresponding quarter last year.

“The numbers reflect the impact of integrating the two businesses, which is already creating new synergies. These include deeper client relationships, the ability to offer cross-market solutions, and entry into new industry segments where the combined capabilities open up fresh opportunities,” the company said in its investor presentation.

The gross profit contribution from Datawrkz’s product businesses rose 40% YoY. Looking ahead, the company plans to leverage Space & Time’s geographic presence and market knowledge to accelerate its expansion in the UK, a market it sees as a key growth driver for its adtech portfolio.

Patching Up The Offline Play

Nazara has also been sharpening its offline play. It acquired a majority stake in Funky Monkeys last year and acquired Smaash earlier this year.

“Funky Monkeys is already on a growth path, adding new centres every month. It’s a highly scalable and profitable business with quick breakeven on the capex we do. We are very excited about it, and you will see continued growth in the coming quarters,” Nazara CEO and joint managing director Nitish Mittersain said during the Q1 earnings call.

Nazara acquired Smaaash via the NCLT process just two months ago and has already begun a two-pronged turnaround.

The team is stabilising and revitalising its 11 existing centres while simultaneously building the “Smaaash 2.0” blueprint, reimagining formats, adding new experiences, and integrating the brand within the broader Nazara ecosystem. The company targets a proof-of-concept within six months and plans to expand aggressively in FY27.

Esports Growth Dims As Nazara Pulls Back From Nodwin

While the gaming and adtech segment delivered strong growth in Q1, Nazar’s esports arm could not keep up with the pace. It saw 17% YoY growth to INR 154 Cr in the quarter. On a sequential basis, the revenue fell 34% from INR 217.11 Cr in Q4 FY25.

This comes at a time when Nazara is deconsolidating its major esports arm, Nodwin Gaming. Nazara has chosen to sit out Nodwin’s latest capital raise, a move that will dilute its stake below 50% and strip it of controlling rights. Analysts say the move is more about its focus on core gaming.

However, the company is framing this as a strategic pivot rather than a retreat. By de-subsidiarising Nodwin, effectively reclassifying it as an associate, Nazara frees up capital and management bandwidth for its core gaming IPs and publishing business — the very segments driving its record growth this quarter.

For Nodwin, the change removes shareholder restrictions, opening the door for larger rounds from external investors who may have previously been wary of a tightly held subsidiary.

“From a capital efficiency standpoint, the move makes sense. Nazara’s gaming segment is now powered by high-margin, globally scalable assets which deliver direct IP ownership and control over monetisation levers. Nodwin operates in a category that’s capital-intensive and still searching for consistent profitability. Allowing it to independently access funding could accelerate its expansion without weighing on Nazara’s balance sheet,” a former top executive at Nazara said.

But the decision isn’t without risk. By giving up control, Nazara will have less say in Nodwin’s long-term strategic direction, potentially weakening synergies between the esports vertical and its owned gaming properties. It also exposes Nazara to valuation risk if external investors push Nodwin toward a path that diverges from its broader gaming ecosystem.

[Edited by Shishir Parasher]

The post Nazara’s High-Stakes IP Gamble Pays Off In Q1 appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)