As India navigates through the roiling waters of geopolitics, its free trade agreement (FTA) with the UK has come as a much-needed respite.

The FTA with the UK, signed last month, attains higher significance for India, with the US slapping it with a 25% reciprocal tariff, along with a penalty, for running trade with Russia, which is at war with Ukraine.

At a time when the US-India relations are experiencing significant strain after two decades of closeness, what does the India-UK trade deal bring to the table? How are different sectors and the Indian economy as a whole expected to benefit from it?

Let’s dive deeper into these questions and many more, as we explore the full extent of this move.

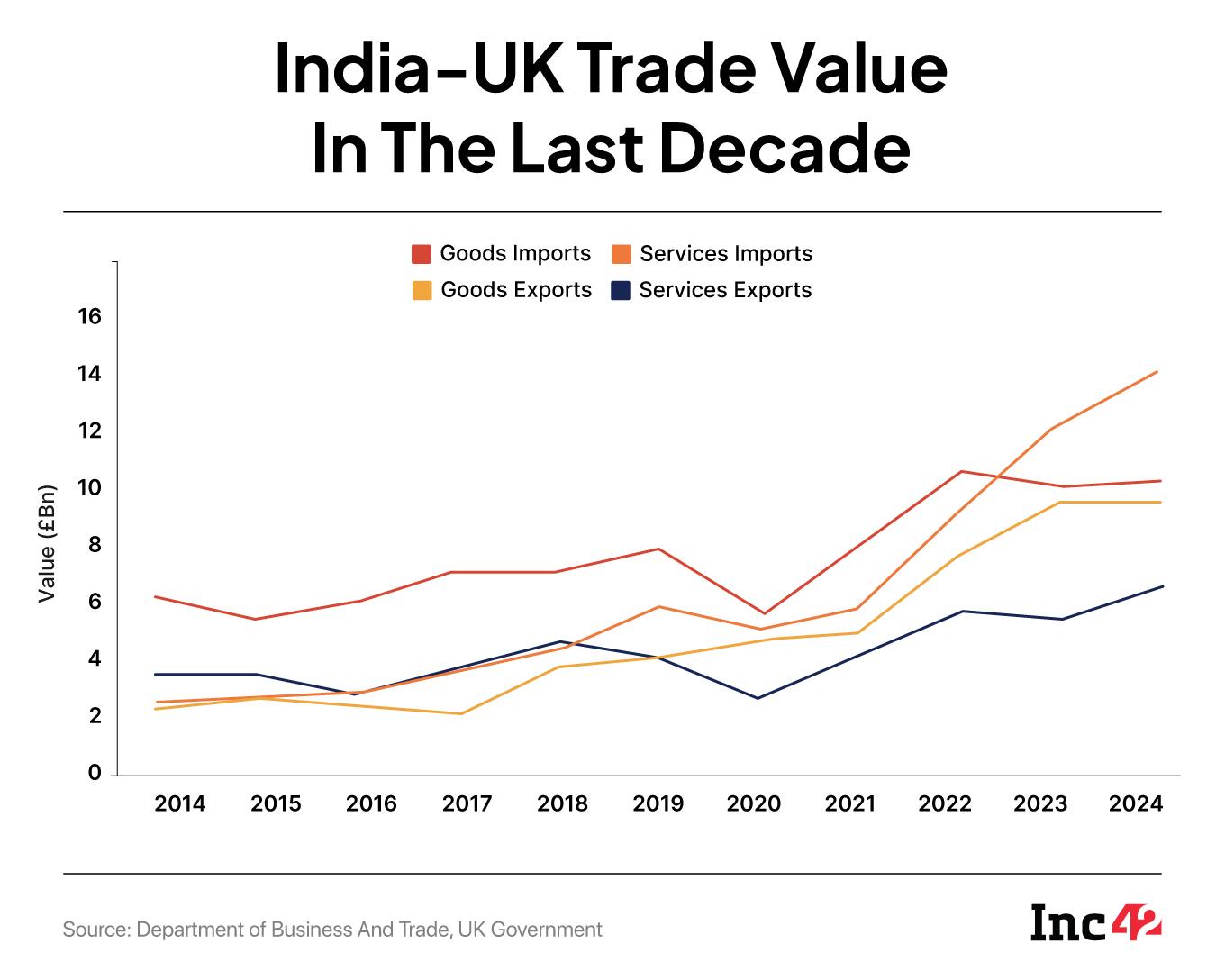

The UK has officially said that this agreement with India is its biggest and most economically significant bilateral FTA since Brexit. India, whose bilateral trade with the UK reached $56 Bn in 2024, aims to double this number by 2030.

However, Barclays has reportedly flagged that the move is “unlikely to alter the current account balance for India meaningfully”, as the UK is India’s seventh-largest trading partner, accounting for 3.5% of its total merchandise exports.

While the short-term gains may not be obvious to everyone, experts believe the deal is slated to bring long-term benefits for both nations.

Also, at a time when India is aiming to expand its exports but faces hurdles in the US, which is its top export market, contributing almost 18% to its merchandise exports, the deal with the UK is indeed a major win at a diplomatic level.

“A major supply chain rebalancing is happening throughout the globe, and the FTA will become a catalyst to that,” said Amit Baid, head of tax at law firm BTG Advaya, which advises global corporates on cross-border M&As, tax litigations, compliances, and more.

Baid said that the UK wants to diversify its sourcing options, and India fits into the equation perfectly, as the US tariff hike could dampen Indian exports. This is where the UK deal ensures a win-win for all.

“The FTA may help us fill the export gap by supplying to the US indirectly via the UK,” Baid added.

The expert is of the view that the pact, once in effect, is expected to be a game-changer for India’s export market and pave the way for future bilateral trade agreements.

But, What’s The UK-India Pact All About?

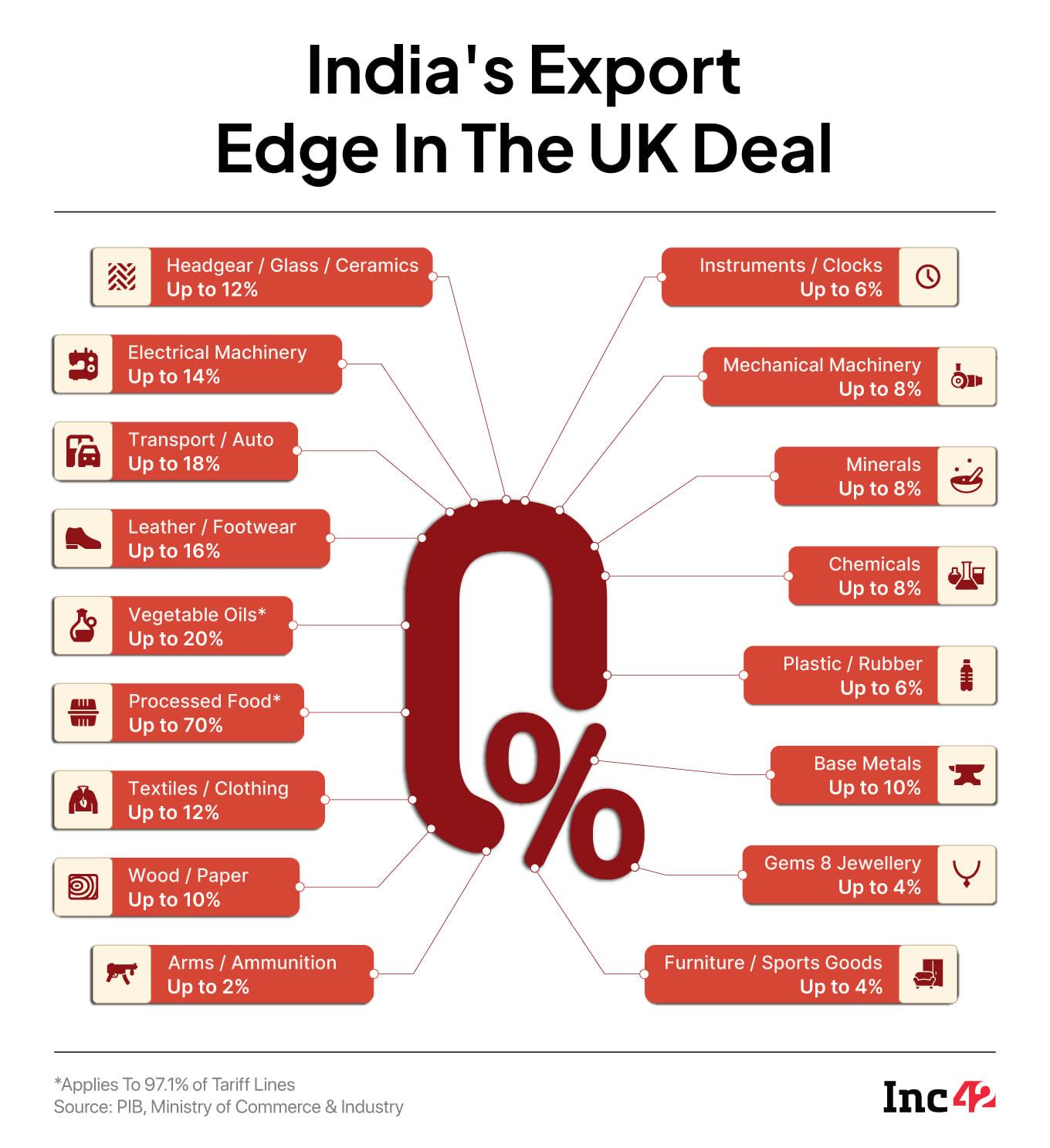

The Comprehensive Economic and Trade Agreement (CETA) gives duty-free access to 99% of Indian exports to the UK.

For instance, export duties on leather and footwear are expected to drop from 16% to zero. Similarly, tariffs on textiles and clothing may be annulled from 12%. Auto parts, which earlier faced up to 18% duty, will also enjoy free access.

India, in turn, has also agreed to slash import duty on British goods to 3% from 15% earlier, excluding dairy and agricultural products.

The UK-India pact covers not just goods but also services. This has the potential to create job opportunities for Indians in the UK and enable knowledge sharing.

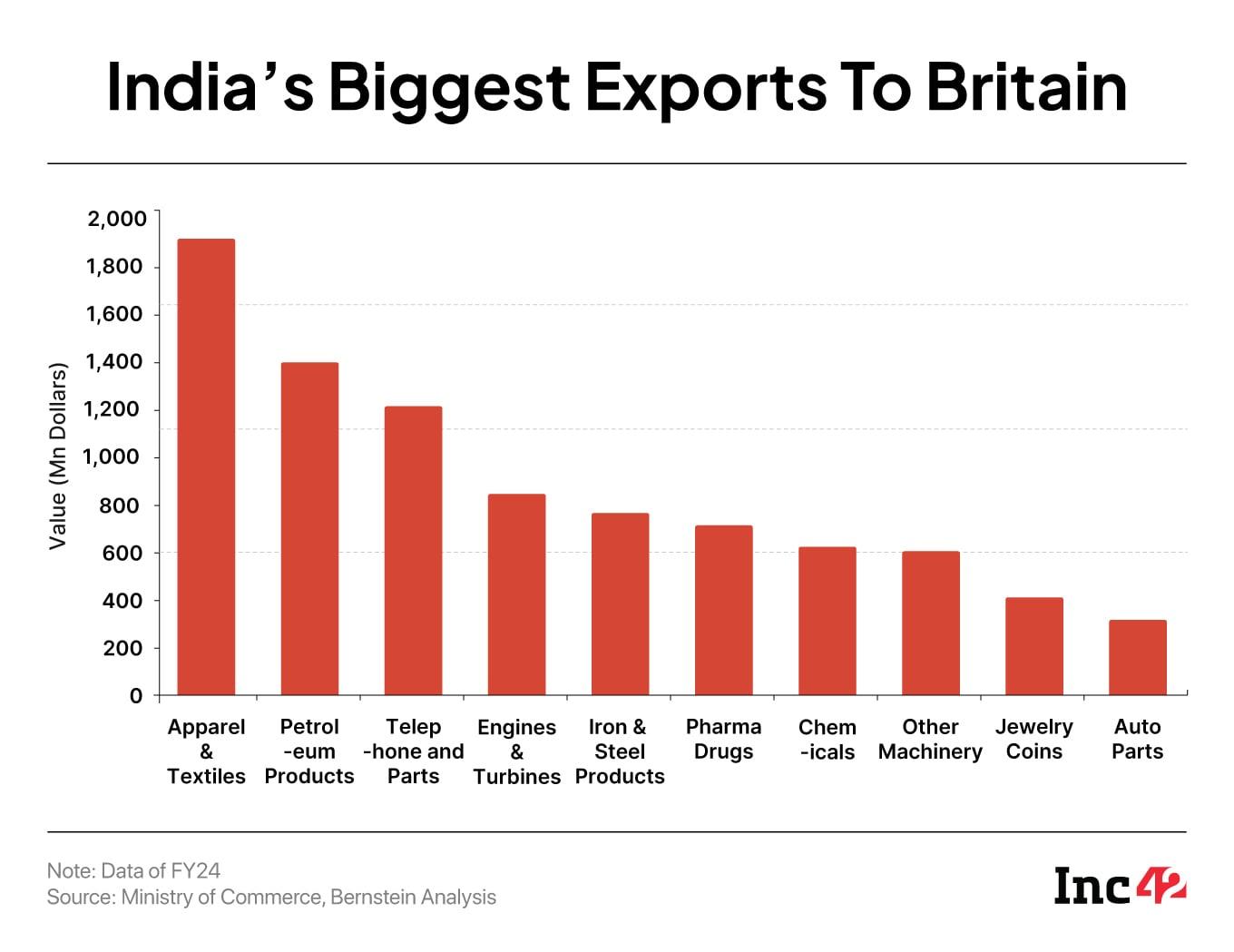

Sectors, ranging from auto and electric vehicles to consumer goods and pharmaceuticals, stand to benefit from this pact in the near to long term. However, apparel, textiles, footwear, and cosmetics could be the early winners.

The UK imported around £1.4 Bn (over $1.8 Bn) of textiles, clothing and footwear from India in 2024, accounting for 14.1% of the UK’s total imports of goods from India.

“The UK imports from India in the textiles, apparel and leather sectors are expected to rise by approximately £2.9 Bn, equivalent to an 85% relative to a baseline of no FTA. This growth in imports is driven by clothing, textiles and footwear, whose imports are estimated to increase by £475 Mn (45%), £175 Mn (40%) and £55 Mn (30%), respectively,” the agreement reads.

So, does this mean that the move could create exciting opportunities for Indian textile suppliers and retail brands to grow in the UK market? If yes, India’s thriving D2C sector is particularly well-positioned to benefit.

Sunrise Moment For Indian D2C Brands?

For Indian D2C brands, it has not been easy to expand geographies. Even though this market has made significant strides, with the fashion apparel and accessories leading the ecommerce race in the country, most new-age brands face challenges in global expansion due to the high cost associated with compliance, setting up direct distribution channels and higher export duties.

“Bangladesh has an edge due to lower labour costs and existing FTAs with western countries. The deal finally narrows that gap for India, especially in value-added products like apparel, footwear, and accessories, where India scores higher in design and speed-to-market,” said Siddharth Dungarwal, the founder of Snitch.

As per Dungarwal, although the UK is a saturated fashion market, there’s a huge gap in affordable premium and trend-led fashion, and “Indian brands have a real advantage because of speed in design-to-market cycles and efficient supply chains”. Plus, the diaspora in the UK gives Indian brands a ready customer base.

He believes that the FTA levels the playing field for Indian D2C brands, as now they would be able to cater to a market where consumers value speed, quality, and brand-led storytelling as much as cost.

For the Snitch founder, too, the trade deal is an attractive proposition to expand in the UK.

“When duties come down, the landed cost of products drops significantly, which means Indian brands can price competitively in the UK while still maintaining healthy margins. Earlier, high tariffs made it tough to set up our own online stores or retail partnerships because pricing after duties would often match or exceed local alternatives,” he said.

However, it is not only the clothing and apparel market that is brimming with hope for international expansion following the trade deal. Food and cosmetics brands would also get a boost in the long run.

Naveen Malpani, partner and consumer and retail industry leader at Grant Thornton Bharat, said lower tariffs will support the growth of processed foods, herbal personal care and wellness products that appeal to British consumers. This will be especially beneficial for MSMEs focussed on value-added and natural offerings.

Meanwhile, Anurag Mehrotra, chairperson at cosmetics brand Fixderma, said that while online will continue to be a core driver after the FTA, he expects the deal to open doors to offline retail, clinical partnerships, and pharmacy chains in the UK.

“The real shift will be in moving from digital-only to a hybrid omnichannel export strategy,” he said.

It’s worth noting, however, that British cosmetics also have a large export opportunity in India. With reduced tariffs, the UK’s exports of cosmetics to India are estimated to increase by 360%. Therefore, Indian D2C brands would need to address other non-tariff challenges to ensure Indian exports outgrow imports.

Tariffs Drop, But Is That It?

As cross-border sales increase, the UK compliance requirement will also tighten. Therefore, D2C brands will need to strive for perfection in the areas of packaging, labelling and safety standards, particularly in cosmetics, food, and wellness, to reap the benefits of the FTA, experts said.

Kannan Sitaram, partner and cofounder of Fireside Ventures and investor in several D2C brands, including Mamaearth, Traya and Kapiva, said that the Indian brands need to rediscover the product-market fit when entering the western markets.

“The organoleptics of food products, preferences in perfumes and cosmetics, and design aesthetics in packaging are very culture-dependent and can vary hugely between India and countries such as the UK. Brands should understand consumers in their cultural context to increase their chances of success when they move into new markets,” he said.

Moving on, while consumer goods stand at the forefront of witnessing a new dawn, with increased volume and growth in exports, the Indian manufacturing sector, including automotive and cleantech segments, has refused to be left behind.

In FY24, India exported auto parts worth about $191.6 Mn to the UK, while imports stood at around $138.6 Mn.

“With tariffs on components set to be significantly reduced, Indian manufacturers, particularly those supplying to global OEMs, are well-positioned to expand their footprint in the UK market,” said Saket Mehra, partner, Grant Thornton Bharat.

He added that the UK-India deal strengthens India’s role in the global automotive ecosystem, as it is also focussed on enhancing market access, encouraging technology collaboration and fostering synergies across the supply chain.

Meanwhile, the UK is looking at increasing its export of luxury cars to India. However, this will be a two-way street, as Indian OEMs will now be able to supply parts to British automotive companies at a low cost.

BTG Advaya’s Baid said that EV components, two wheelers, parts of motors, batteries, and chargers will have easier access to the UK market with the tariff elimination. Besides, the trade agreement may also boost contract manufacturing and assembly of auto parts in the country.

Beyond this, the deal opens doors for R&D in battery innovation, hydrogen, light EV technology, as well as clean and climate tech innovations.

However, the Indian economy may not witness a sudden boost, especially when the US is playing a spoilsport, discrediting the relationship that took years to be forged between the two global powerhouses.

All in all, the UK-India agreement is one of India’s most comprehensive deals with a western economy, as it aligns strongly with its digital ambitions and opens new doors for startups and innovation-led growth. While global headwinds may delay immediate gains, the long-term potential is undeniable. Still, the question remains — how long will it take before we get to see the green shoots finally emerge?

[Edited by Shishir Parasher]

The post India-UK FTA Sets Stage For Next-Gen Trade Ties, But What’s In It For Startups? appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)