Nearly two decades after its incorporation in 2007, Myntra announced last month that it marked its first international foray under the new ‘Myntra Global’ banner. The fashion ecommerce marketplace has launched its operations in Singapore.

The Flipkart-owned platform aims to leverage brand loyalty to drive cross-border commerce by tapping into the Indian diaspora of around 6.5 Lakh people in the island nation.

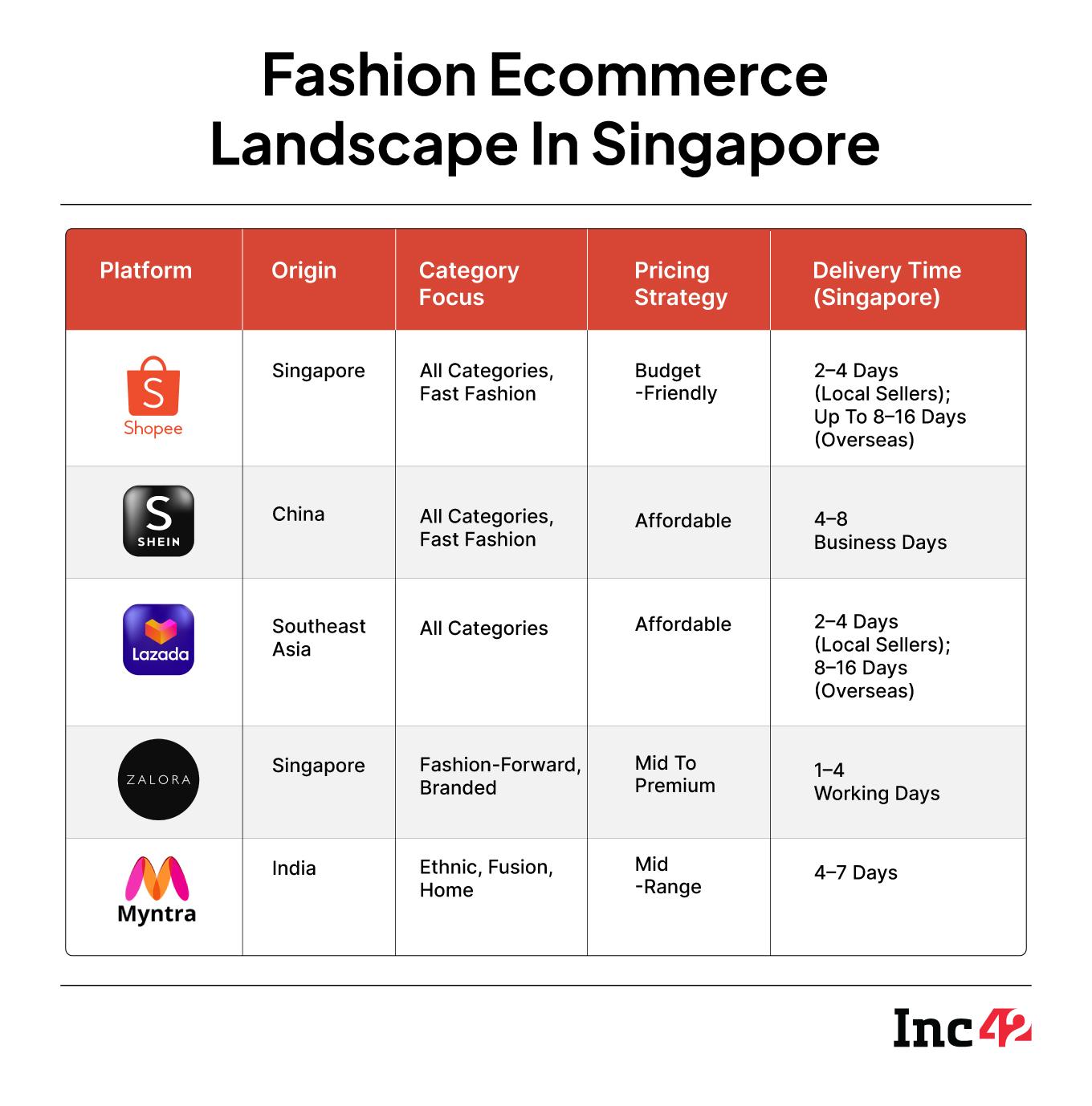

However, while the brand’s intent is clear, the timing and choice of market raise some concerns. For starters, Singapore isn’t going to be an easy market, especially for a newbie like Myntra. This is because the region is filled to the brim with players like Shopee, Shein, Lazada, and Zalora that enjoy a strong brand recognition and stickiness.

Then, experts believe, Singapore-based shoppers are highly selective, constantly seeking great deals and ahead of the rapidly evolving fashion trends. This, among other factors, could make Myntra’s Singapore entry arduous.

So, what makes industry observers say so? Why isn’t Singapore a promising market for Myntra to begin with? What are the stakes at play here — the hits and the misses? Let’s get right into these questions to make sense of Myntra’s Singapore foray.

A Strategic Experiment?

Myntra’s entry into Singapore isn’t just about going global, it’s a strategic experiment to understand how Indian fashion resonates beyond borders.

According to CEO Nandita Sinha, the core of this launch is Myntra’s attempt to test the waters and understand the product-market fit for Indian fashion in an overseas setting.

But why Singapore? Well, the choice was driven by data. Myntra has found that about 10–15% of its web traffic comes from international markets, and Singapore stands out as a concentrated and engaged segment.

According to Statista (2024), approximately 6.5 Lakh Indians reside in Singapore, with around 3 Lakh Persons of Indian Origin (PIOs). Sinha pointed out, “While analysing our data and exploring potential market opportunities, we discovered that nearly 30,000 of these users are visiting our platform every month.”

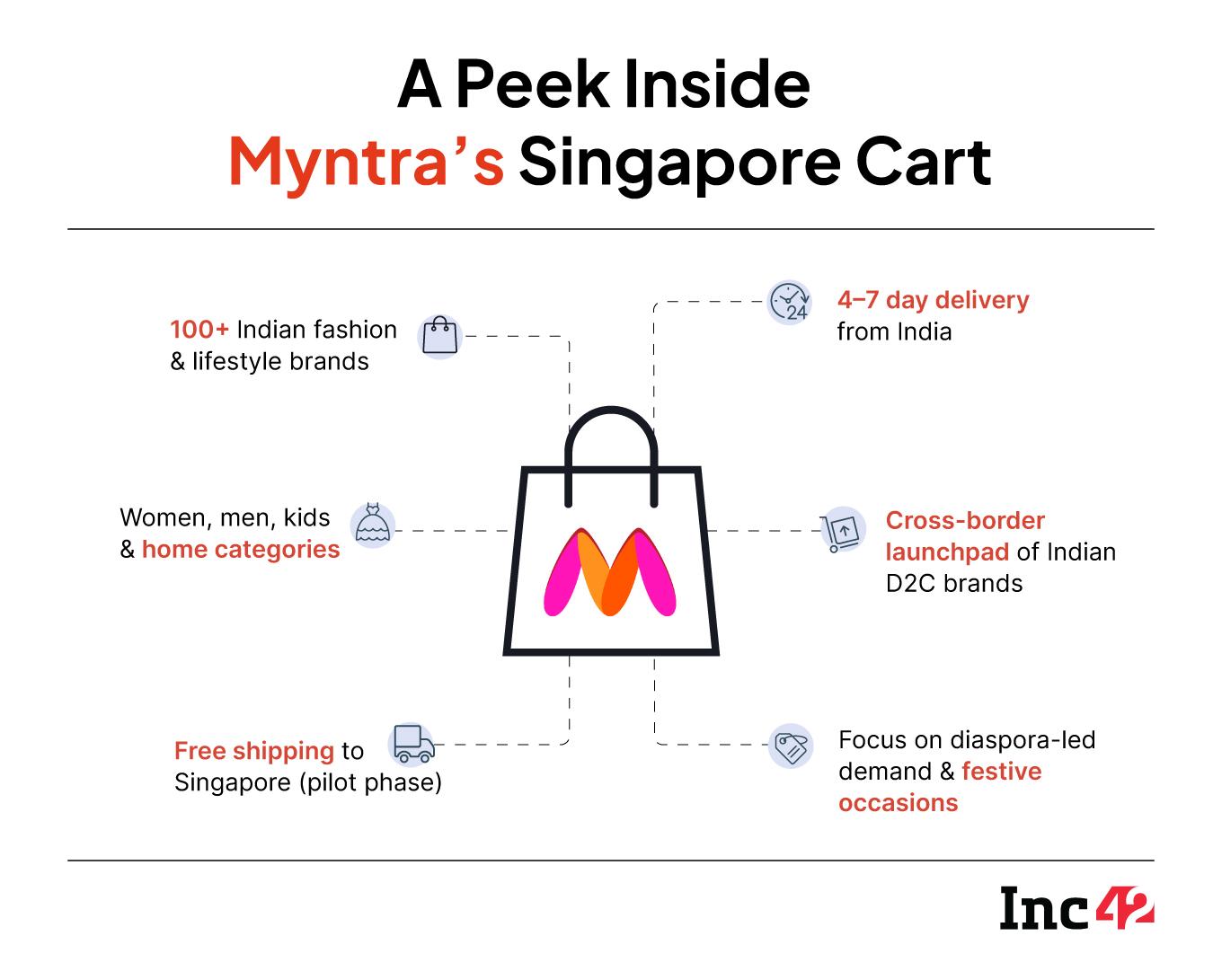

This organic interest gave the company confidence to make Singapore its first stop under the Myntra Global banner. The platform has gone live in Singapore with 35,000+ styles, which it now plans to scale up to 1 Lakh in the near future.

However, what’s interesting is that Myntra is betting big on desi styles and brands to cater to the Indian diaspora in Singapore. The platform has launched a curated lineup of over 100 Indian brands, including popular names like Aurelia, Global Desi, AND, Libas, Rustorange, Mochi, W, The Label Life, House of Pataudi, Chumbak, Anouk, Bombay Dyeing, and Rare Rabbit.

Whether it’s ethnic wear, fusion fashion, or home décor, the idea is to spotlight Indian design and craftsmanship. Not to mention, Myntra sees significant potential for cultural occasions such as festivals, weddings and special celebrations.

As per Devangshu Dutta, the founder and chief executive of Third Eyesight, Singapore is an ideal market for Myntra’s international test run due to several reasons. For one, it is a digitally advanced, high-income market with a significant Indian diaspora that is familiar with the brands Myntra offers.

“This makes it a natural nucleus for testing an out-of-India offering,” Dutta said, adding that Singapore’s relatively small size makes it easier to manage the complexities of merchandising across different segments, potentially making it a more efficient testing ground.

Moreover, if the business succeeds, Singapore could serve as a strategic launchpad for Myntra to expand into other Southeast Asian markets. However, for now, Myntra’s Singapore launch is less about scale and more about learning.

Ankur Bisen, senior partner and head at Technopak Advisors, said that Myntra’s recent expansion makes strong strategic sense. This is because it is no longer an Indian company, and expanding to Singapore and Southeast Asia offers significant scale and growth opportunities.

“Unlike a purely Indian company, Myntra can explore multiple markets simultaneously and is not restricted to focussing solely on India,” Bisen said.

However, not everything is rainbows and sunshine, as Myntra’s success will only hinge on pricing, local adaptation, and understanding the distinct preferences of the Indian diaspora in Singapore that may be different from Indian buyers. In simple terms, one size may not fit all.

Then, shipping delays and high logistics costs could dilute the value proposition, especially in a market like Singapore where consumers are used to fast and affordable service.

Imperative to mention that Myntra currently has no plans to set up a warehouse in Singapore. Myntra CEO Sinha mentioned that products would be shipped directly from India, where the inventory will be maintained by the brands themselves.

“Myntra Global was not intended to be a localised service tailored to the Singapore market or any other international location. Instead, the focus would remain on serving global consumers from India, with no immediate plans for physical expansion or local warehousing.”

What Could Go Wrong?

Expanding into a new market is always a risky affair. Some potential pitfalls for Myntra could be logistics complexities, return management, and supply chain localisation.

Yash Dholakia, partner, Sauce.vc, too, pointed out that execution risks extend beyond pricing and scale to include logistics, returns, and supply chain.

Dholakia added that Singapore is a different ballgame altogether, as its distinct retail landscape is not an easy feat. “The fashion industry’s fast-changing nature calls for a sharp understanding of Singapore’s diverse, millennial consumers, who have unique cultural preferences and social media-driven buying habits.”

Moreover, many second- or third-generation PIOs see themselves mainly as Singaporean and have different cultural and fashion preferences.

Therefore, assumptions that what works in India will work for this class of consumers may lead to failure.

To hedge this, Myntra will have to take a fully local approach, which will include setting up independent teams on the ground to understand and address these local differences, rather than just copying and pasting its India playbook.

Moreover, from a branding and market reach perspective, targeting just the 10–15% Indian diaspora in Singapore restricts Myntra’s audience significantly. The fashion market in the city-state is already competitive, with several efficient players offering fast and affordable options.

“Myntra’s edge would primarily be Indian ethnic wear, which restricts its ability to emerge as a broad-market contender,” Dholakia said.

Per Dutta, relying heavily on the Indian diaspora may provide a strong initial boost, but this may not sustain for too long.

A Launchpad For D2C Brands

This is not the first time Myntra has tried to enter an international market. In 2020, Myntra partnered with UAE-based platforms, noon and Namshi, to enter the Middle East with a few Indian brands.

However, its current expansion into Singapore looks more ambitious with a cavalry of over 100+ Indian brands.

To strengthen its footprint in Singapore, Myntra is offering free shipping across a wide range of categories, including women’s fashion, kidswear, and home essentials.

Myntra is offering products across a wide range of price buckets. In the women’s tops category, prices start as low as INR 350 with brands like Tokyo Talkies, and go up to INR 4,800 with brands like Berrylush, DressBerry, and Vishudh. Western dresses also extend up to INR 7,100. In ethnic wear, kurtas range from INR 833 to over INR 3,800, while sarees are priced between INR 1,200 and INR 18,000.

“In terms of pricing, it’s ultimately the brands themselves that determine their price positioning on the platform. As they begin listing and transacting with consumers, they will decide how they want to price their products,” said Sinha.

In addition, what could work in its favour is the opportunity to give the global audience a taste of fast-growing Indian D2C brands.

Many Indian internet-first brands haven’t had the chance to engage with global consumers before, but this expansion lets them showcase their products directly to the Indian diaspora in Singapore.

Besides, the expansion will allow Indian brands to understand new consumer preferences, optimise their product mix for cross-border demand, and grow their presence beyond India.

This pilot could indeed spark broader cross-border opportunities for Indian D2C brands. But it demands localised marketing, deep consumer understanding, and a willingness to adapt to regional preferences.

For brands used to making for Indian buyers, this could be a steep but rewarding learning curve. If executed well, it offers them not just an entry into Singapore but a scalable template for global expansion.

The Cross-Border Gamble

Myntra’s global play comes at a time when the ecommerce platform posted a net profit of INR 30.9 Cr in FY24 versus a loss of INR 782.4 Cr in FY23. This turnaround came on the back of a 15% increase in its operational revenue and tighter cost control.

The platform generates revenue through a mix of transaction fees from sellers, logistics services, advertising, and its private labels. To move towards profitability, Myntra brought down its total expenses to INR 5,123 Cr in FY24 from INR 5,290.1 Cr in FY23.

However, its recent entry into Singapore may bring new financial challenges, even as Myntra has opted not to set up a warehouse in Singapore. It would rather ship products from India through third-party logistics providers.

So, is the fashion major being penny-wise and pound-foolish?

Probably. While this asset-light model avoids upfront capital expenditure, it introduces risks such as longer delivery times, higher logistics costs, customs delays and complicated return processes that could sour customer sentiment. For a platform that just turned profitable, these are crucial levers that could strain margins.

Further, even though Myntra is not offering exchange and returns currently, once it does, it could complicate things further.

This is because shipping a 2 Kg fashion parcel from India to Singapore costs an estimated INR 2,800 to INR 3,500, inclusive of air freight, GST, and last-mile delivery. Reverse logistics could add another INR 1,200 to INR 2,000 per item, pushing the total cost per cross-border order significantly higher.

According to Dibyanshu Tripathi, cofounder and CEO of Hexalog, a logistics company, cross-border logistics could significantly impact Myntra’s profitability as it expands into Southeast Asia.

“Sustaining margins will be challenging with high per-order shipping costs, return expenses, and longer delivery timelines that may affect customer satisfaction. Without localised infrastructure or cost efficiencies, profitability in new markets may be hard to maintain despite revenue growth,” Tripathi said.

In contrast, players such as Lenskart and Nike have structured their global expansions with supply chain control at the core.

All in all, Myntra’s Singapore foray is a bold experiment aimed at testing global appetite for Indian fashion, especially among the diaspora.

While the move offers promising opportunities for Indian D2C brands and cross-border growth, it’s also fraught with challenges. For one, with a lack of local infrastructure, high shipping costs and a diaspora divided between two cultures, sustaining this expansion may prove tough. Can Myntra turn its Singapore pitch into a lasting global success story?

[Edited By Shishir Parasher]

The post Can Myntra Dominate Singapore Streets With Desi Styles? appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)