India, a $66.66 Bn-strong pharma giant, is in the throes of a chronic illness. Medical expenses are eating into the household budget, pushing the average Indian to shell out INR 135 in rural areas and INR 250 in cities every month, shows the government’s monthly consumption expenditure survey.

Why can’t India heal itself despite fostering the 14th largest pharma industry in terms of value and third in volumes? It is also the largest supplier of generic medicines, making up 20% of the global supply, and continuing to be a key player in affordable vaccines.

Yet, more than 1.6 Mn lives are crushed every year in the country because of inadequate healthcare.

A combination of high pollution levels, poor healthcare infrastructure, and limited access to quality doctors has heavily accentuated the drug dependency in India, while the cost of prescribed branded drugs kept building pressure on the household budget.

In India’s bustling startup economy, this drug dependence has paved the way for online medicine delivery platforms and what began as home delivery services, has evolved into the 10-minute doorstep delivery of medicines.

“That’s where we spotted the opportunity,” said Akshat Nayyar. He set up Truemeds with his former colleague Dr Kunal Wani based on this doorstep delivery format for low-cost generic drugs. “In the US and other developed markets, prescriptions are written in salt (generic) names, not brand names. That ensures patients can access the most cost-effective option. But in India, the ecosystem was still skewed heavily towards branded drugs.”

Truemeds positioned itself on the paradox of rising cost of branded medicines in a market reputed for low-cost generics.

An Irony Evolves Into An Idea

Truemeds is the story of an irony fostering an idea. The founders were colleagues in global pharma major Abbott. Together, they facilitated the very brand-driven ecosystem that their brainchild sought to disrupt, a few years later.

The seeds of the idea had possibly germinated when the Medical Council of India (MCI) mandated that doctors should prescribe drugs by their salt (generic) names, and not brand names. The move was intended to make medicines more affordable and accessible.

When Nayyar was tasked to assess the impact of this regulatory shift on India’s retail drug market, he noticed that no organised player was focussed on bridging the affordability gap by helping patients access quality generic alternatives.

Although the MCI’s mandate faced resistance from doctors, the government doubled down on it in 2018, asking pharma companies to print the generic names of drugs in a font as large as the brand name. Even government hospitals were directed to prescribe the salt and not the brand. This regulatory nudge was squarely aimed at weakening the unholy nexus between drugmakers and doctors.

Truemeds was rolled out in 2019 to bridge this gap. The platform began as a listing service, allowing patients to compare alternative medicines – somewhat akin to Zomato’s early model of restaurant discovery. But rising consumer interest quickly pushed the founders to evolve into medicine delivery, directly linking affordability with accessibility.

Sitting at the intersection of regulatory intent and consumer need, the startup has so far raised over $100 Mn, including a recent $85 Mn round, led by Accel and Peak XV Partners. “We are not offering the cheapest options out there. What Truemeds does is it offers the right value for money while ensuring quality,” Nayyar said.

Making Money From The Market Gap

Spotting the market gap wasn’t enough, the real test was execution at scale. Identifying a cheaper substitute to a branded drug is easy – a Google search quickly lists the alternatives. The real bottleneck is in ensuring that lesser-known generic brands actually reach the consumer’s doorstep.

For branded medicines, the system is well-oiled. Pharma companies know which doctors are prescribing their products, distributors stock accordingly, and pharmacies carry predictable inventories, often with 45 days of supply on hand. This not only ensures strong visibility for the branded drugs, but it also establishes their dominance.

Generics, by contrast, operate in a fragmented and uncertain environment. Smaller manufacturers rarely have visibility into demand trends, making distribution patchy and inconsistent. This is why, even today, big brands control nearly 88% of India’s pharmaceutical market, despite the availability of low-cost alternatives, said the founder.

“We told these smaller manufacturers that we will generate demand for you, based on our growing customer base. In turn, this allows us to work with better margins and pass value to customers,” Nayyar said.

In a typical pharma supply chain, out of an INR 100 medicine, a branded drug company keeps a 60-70% margin. This accounts for heavy spending on advertising, packaging, branding, and creates room for medical representatives to push their products. What trickles down is a meagre 10-15% margin that pharmacies and online platforms like Tata 1mg or PharmEasy make.

Truemeds flips this structure. By cutting out brand marketing and medical representative costs, the startup captures 50-60% margins before discounting, and 20-30% after discounts, while still offering medicines at a lower price to patients. This dual advantage – higher margins for Truemeds and lower costs for consumers – lies at the core of its operating model.

In fact, Truemeds has begun showing the scale in revenue terms. A better margin profile helped it reach a topline of INR 510 Cr in FY25, making a 57% on-year surge, with an average order value of INR 1,000 to INR 1,500. To further expand the AOV and capture more of the healthcare wallet, the startup has begun diversifying its product assortment, adding vitamins, oral care products like toothpaste and mouthwash, and other essentials typically purchased from pharmacies.

“Truemeds is not just a fulfilment partner, but also a demand generator and educator,” Nayyar noted.

Prescribing Blueprint For Future

For Truemeds, the biggest cost load is customer education and acquisition. “Educating the user is our biggest pain point,” Nayaar said. Unlike pharmacies, which rely on prescriptions to drive demand, Truemeds needs to convince consumers to shift from branded drugs to generic substitutes. This required sustained marketing in the form of campaigns and awareness building.

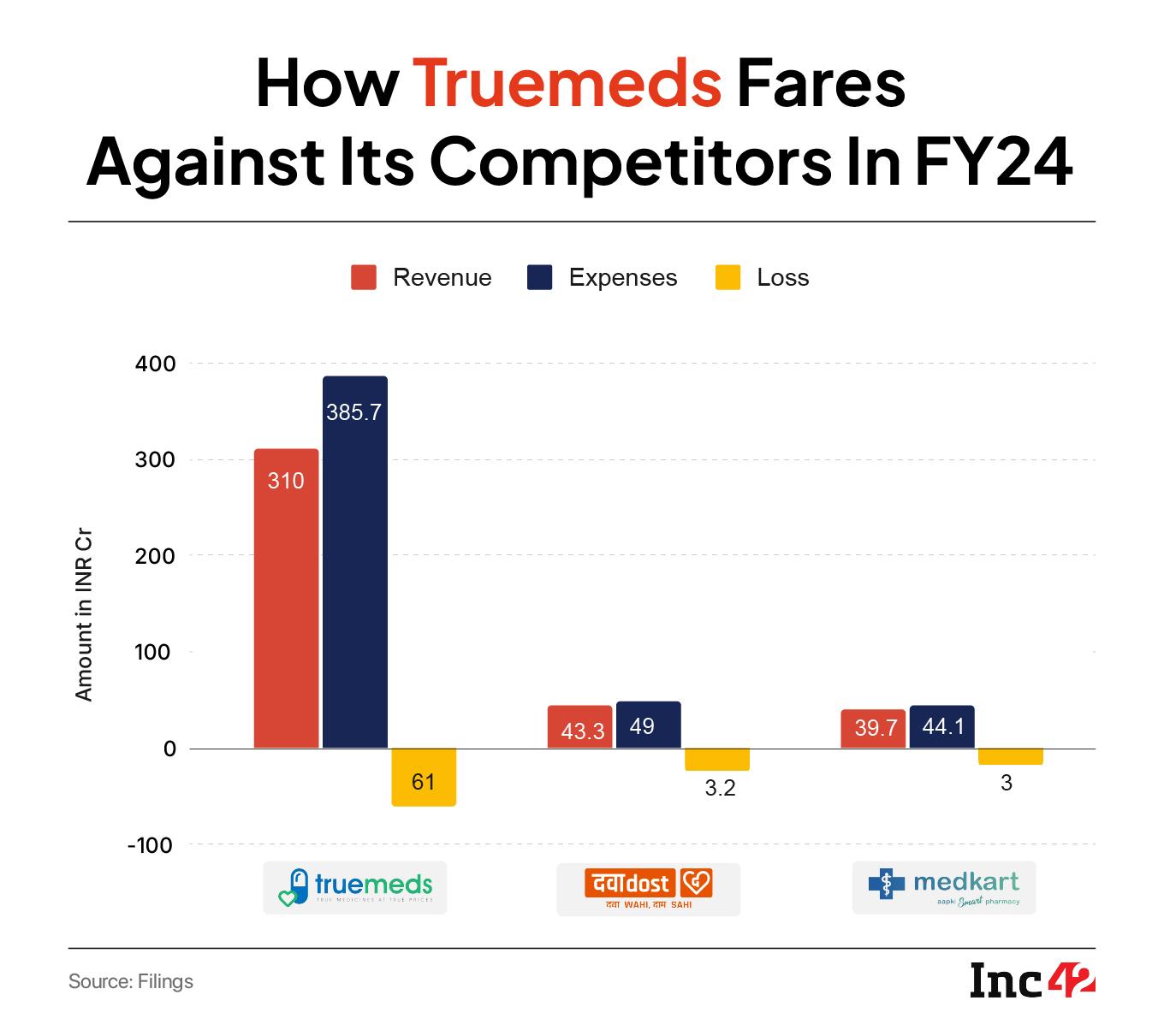

Despite a good margin, this is the very reason why there are very few generic medicine platforms and those that are there, such as MedKart and Dawa Dost, have not been able to scale much.

Once acquired, though, retention is less of a concern. “If you start saving 40-50% on your chronic illness medicines, you would want that to continue,” he explained.

Chronic or non-communicable diseases are on the rise across the world, making up 73% of all deaths. In India, non-communicable diseases cause 53% of deaths and 44% of disability-adjusted life-years lost. In fact, revenue in pharmacy business varies directly with increasing chronic diseases and age.

The startup is also exploring adjacent healthcare services. “We saw that most chronic patients need to undergo blood tests, and there is a genuine demand. We’re planning to launch this in the next couple of quarters in select locations,” Nayyar shared.

The startup is also exploring adjacent healthcare services. “We saw that most chronic patients need to undergo blood tests, and there is a genuine demand. We’re planning to launch this in the next couple of quarters in select locations,” Nayyar shared.

The startup plans pilot diagnostic services through partnerships with labs in Tier II and Tier III towns.

While its peers like Tata 1mg and Apollo have jumped on the quick commerce bandwagon, Truemeds has no such plans, but Nayyar mentioned that it will deliver medicines in one day. In quick commerce, he said, the AOV is as low as INR 400, which makes fulfilment costs disproportionately high and erodes any discounts passed on to patients. “For us, the economics have to work in a way that savings are sustainable for the user.”

For Truemeds to make true progress in the business, there is a need for more trust in generics among consumers in India, where costly, branded medicines enjoy an edge in the market over cheap generic drugs.

Edited By Kumar Chatterjee

The post In Generics Game, Truemeds Pops A Margin Pill, Cracks The Pricing Code appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)