Reliance Eyes Slice Of OpenAI Pie

OpenAI is moving East in search of its next big funding meal. The AI juggernaut has held talks with homegrown conglomerate Reliance Industries, along with Saudi Arabia’s Public Investment Fund and UAE-based existing shareholder MGX, to raise the second tranche of its $40 Bn fundraise.

The conglomerate could potentially pump “at least hundreds of millions of dollars” during the round, which could peg OpenAI at a staggering $300 Bn post-money valuation.

Why Reliance? For Reliance, the deal makes sense as a stake in OpenAI could help integrate advanced AI offerings into its extensive network that ranges from telecom to retail. On the other hand, the AI major is leaning on its growing relationship with Reliance Jio as the two companies recently discussed plans to distribute and sell the former’s AI offerings in India.

The Broader Impact: The potential partnership could pave the way for an Indian company to have a say in how the biggest AI platform globally operates. With a local backer in its kitty, OpenAI could also accelerate the development of AI solutions tailored for Indian languages and use cases, while positioning the country as a major AI hub rather than just a consumer market.

The potential investment is likely a strategic manoeuvre that could position Reliance at the heart of the global AI revolution. Besides, much is set to get disrupted as Reliance readies the cauldron for OpenAI’s funding feast.

From The Editor’s Desk

Why Mainstreet Hung Up Its Shoes: Despite raising about $2 Mn in 2023, the sneaker marketplace burned cash on excessive salaries, marketing, and avoidable operational costs. Here’s how the Kunal Shah-backed startup crumbled under its own weight.

GIVA’s INR 500 Cr Revenue Run: The omnichannel D2C jewellery startup has created a niche in the silver and lab-grown diamond space with its focus on price-conscious Gen Zs and millennials. Here’s how GIVA is leveraging online consumer data to fuel offline expansion

SEBI Plans Co-Investment Overhaul: SEBI’s proposed CIV model aims to streamline co-investments under AIFs, enhance transparency, and reduce compliances. While promising, concerns around taxation, rigid exit norms, and operational complexity could hinder VC adoption.

Meesho’s Desh Wapsi On The Anvil: The ecommerce major, which is set to file its IPO papers in a few weeks via the confidential route, will likely complete its redomiciling process from the US to India in the next few days.

WestBridge On Spinny’s Cap Table: The used-car marketplace unicorn has raised an additional $30 Mn from the investor in its Series F funding round. The startup has closed its Series F at $170 Mn in a mix of primary and secondary deals.

PhonePe, Google Pay Lead UPI Race: The two fintech platforms together accounted for nearly 85% of UPI market share in May. PhonePe recorded 868.20 Cr transactions worth INR 12.56 Lakh Cr last month. Google Pay’s UPI transaction volume rose 4% MoM to 674.04 Cr.

ArisInfra’s INR 500 Cr IPO: Nearly seven months after receiving the SEBI’s green light to float an IPO, the B2B ecommerce company has filed its RHP to raise about INR 500 Cr via the public markets. Its IPO will open for subscription on June 17 and close on June 20.

Krutrim Unveils Agentic AI: The Bhavish Aggarwal-led AI unicorn has unveiled Kruti, a Gen 2 AI multimodal assistant, which can analyse text, voice, and image and generate in-depth reports. Available in 11 languages, it helps users order food, book cabs and pay bills.

Inc42 Startup Spotlight

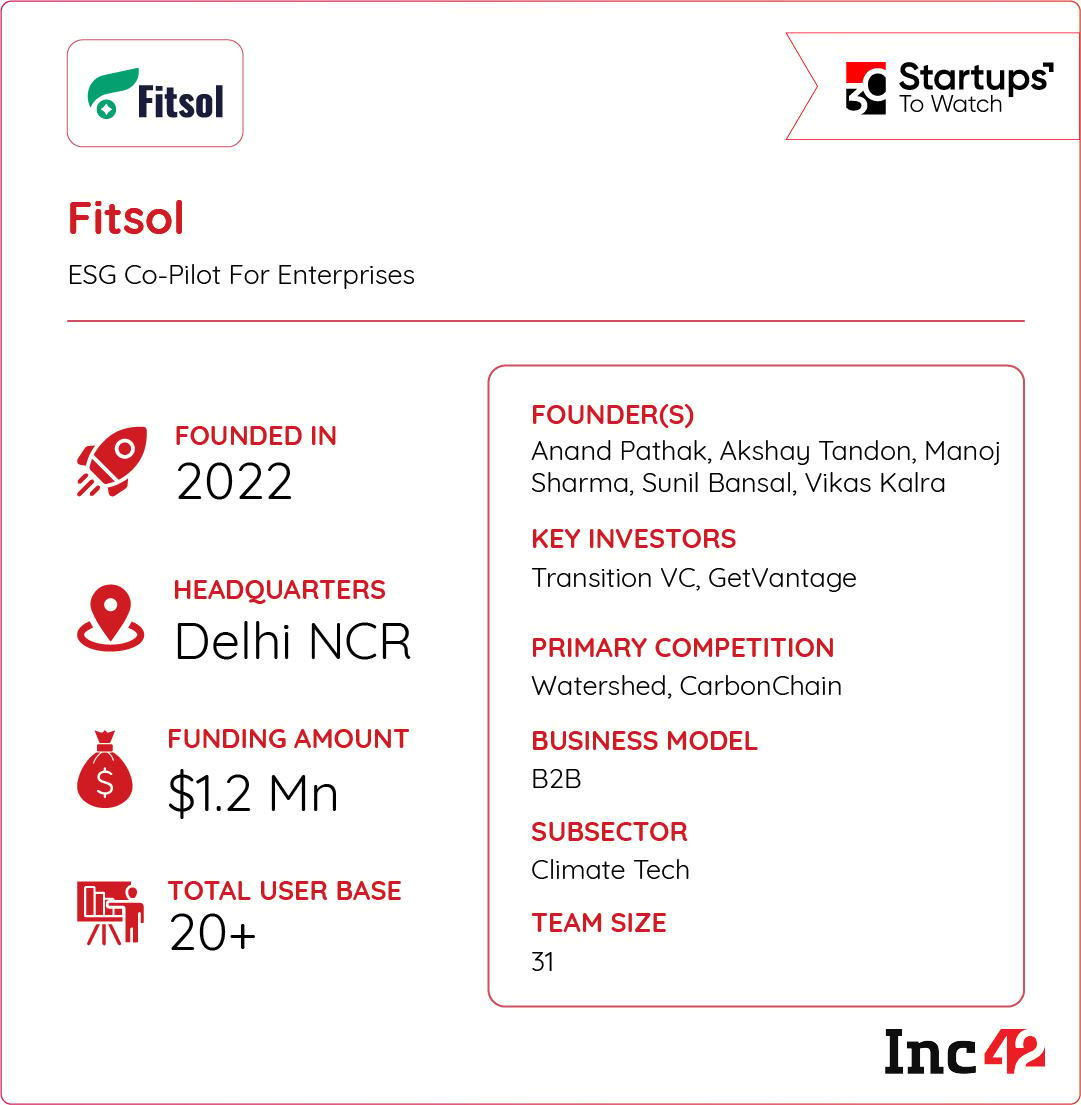

Can Fistol Become The Go-To ESG Copilot For Businesses

As businesses race to meet environmental regulations and ESG goals, tracking and reducing carbon emissions remains a tough nut to crack, especially Scope 3 emissions. These indirect emissions, which occur across a company’s value chain, are notoriously hard to measure and typically make up more than 70% of a company’s total carbon footprint.

Fitsol’s AI-Powered Play: Founded in 2022, Gurugram-based Fitsol offers an AI-powered carbon management platform that helps organisations measure, report, and reduce emissions across Scope 1, 2, and 3.

It delivers real-time ESG reporting, customised decarbonisation strategies, and AI-driven recommendations. The platform also features a sustainability marketplace for carbon credits and eco-friendly alternatives.

What’s On The Horizon? With $1 Mn in seed funding, Fitsol is doubling down on its AI capabilities to support industries in their net-zero journey. By integrating emissions tracking, ESG compliance, and reduction tools into one seamless platform, Fitsol is positioning itself as a go-to solution in the growing climate tech space.

Nevertheless, in a world where corporate sustainability is no longer optional, can Fitsol help businesses simplify the complexities of carbon management?

The post RIL Eyes Slice Of OpenAI Pie, Why Mainstreet Hung Up Its Shoes & More appeared first on Inc42 Media.

Original Article

(Disclaimer – This post is auto-fetched from publicly available RSS feeds. Original source: Inc42. All rights belong to the respective publisher.)